Let Finli mind your business for you. We keep payments safe and never share or sell your customer data.

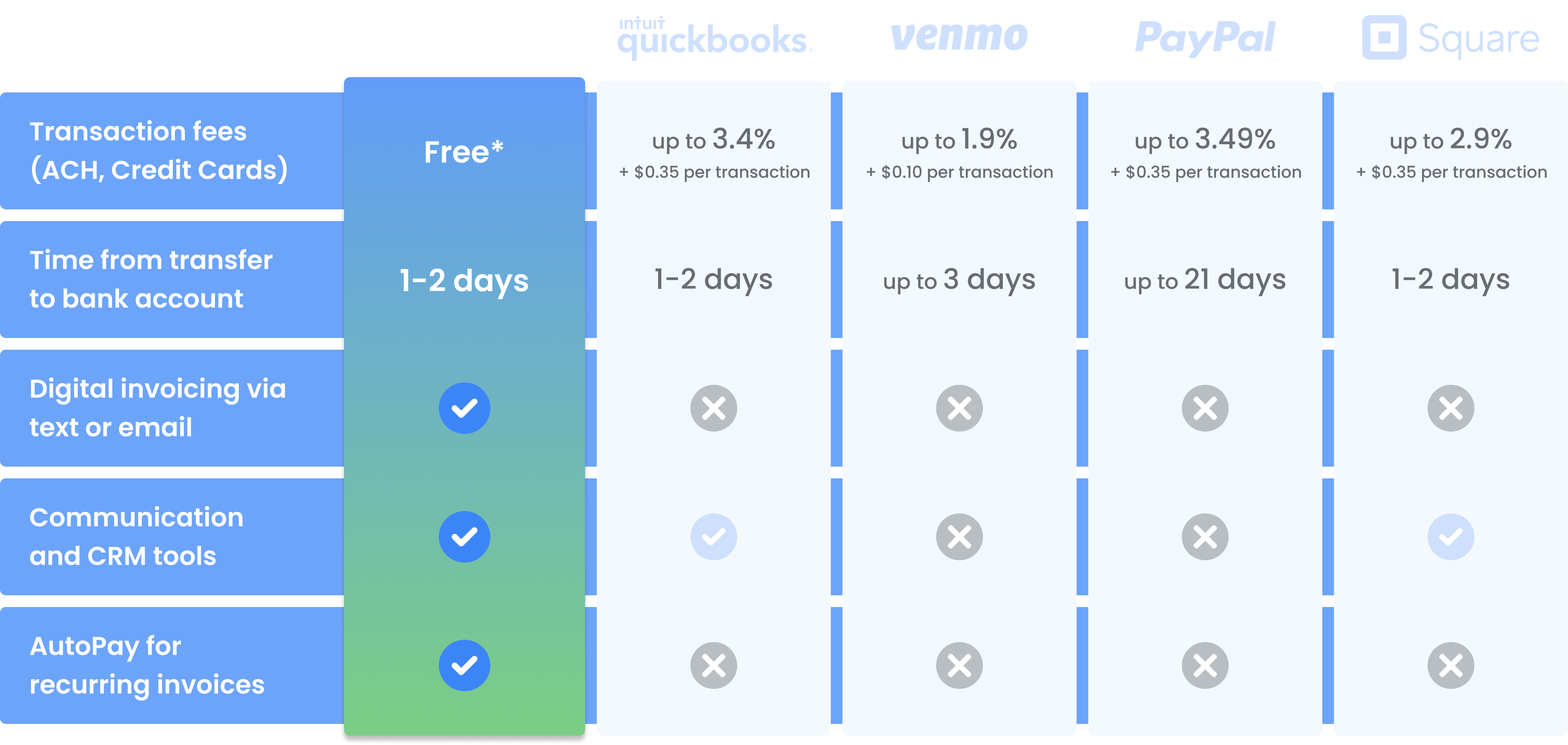

¹ Option to pay 3% CC transaction fees or charge back to customers.

Take your business to new heights with faster invoicing, streamlined customer management, and no ACH fees.

¹ Option to pay 3% CC transaction fees or charge back to customers.

See how Finli stacks up against other platforms.

If you’re a business operating with a U.S.-based bank account, you’re Finli material! As long as you can process ACH (bank-to-bank) payments, you’ll be good to go.

Our customers range from dog walkers to martial arts studios and everything in between, so as long as you meet the criteria above, you’ll be in good company.

Finli is a web-based platform, so no need to add a new app to the mix.

You can access all of Finli’s features on any mobile device or tablet by logging in to your portal using a mobile browser at portal.finli.com/login.

Finli initiates an ACH transfer as soon as your customer makes a payment. The transfer process (from Finli to your bank account) typically takes 24-48 hours to initiate, so you should expect to receive funds 2-4 business days after your customer’s initial payment. The exact timing may vary based on financial institutions and the method by which your customer pays.

Absolutely – we’re always happy to chat! Contact us through the chatbot on the website, email us at support@finli.com, or call us during regular business hours at (866) 343-4654.

At Finli, we firmly believe that small businesses drive the economic success of their neighborhoods. That’s why we prioritize partnerships with community-minded banks, like credit unions, minority depository institutions (MDIs), and community development financial institutions (CDFIs).

Real customer success stories, expert business advice, and more.

If you’re a business operating with a U.S.-based bank account, you’re Finli material! As long as you can process ACH (bank-to-bank) payments, you’ll be good to go.

Our customers range from dog walkers to martial arts studios and everything in between, so as long as you meet the criteria above, you’ll be in good company.

Finli is a web-based platform, so no need to add a new app to the mix.

You can access all of Finli’s features on any mobile device or tablet by logging in to your portal using a mobile browser at portal.finli.com/login.

Finli initiates an ACH transfer as soon as your customer makes a payment. The transfer process (from Finli to your bank account) typically takes 24-48 hours to initiate, so you should expect to receive funds 2-4 business days after your customer’s initial payment. The exact timing may vary based on financial institutions and the method by which your customer pays.

Absolutely – we’re always happy to chat! Contact us through the chatbot on the website, email us at support@finli.com, or call us during regular business hours at (866) 343-4654.

At Finli, we firmly believe that small businesses drive the economic success of their neighborhoods. That’s why we prioritize partnerships with community-minded banks, like credit unions, minority depository institutions (MDIs), and community development financial institutions (CDFIs).