Drive SMB Deposits.

Deliver More Value.

Grow Your Bank.

Finli helps financial institutions attract and deepen small business relationships by solving their most pressing challenges.

Finli helps financial institutions attract and deepen small business relationships by solving their most pressing challenges.

Finli helps financial institutions attract and deepen small business relationships by solving their most pressing challenges.

Small business owners need tools that make their lives easier — if you’re not offering them, someone else is.

Small business owners need tools that make their lives easier — if you’re not offering them, someone else is.

Your traditional checking account + ACH products just aren’t moving the needle.

Instantly launch impactful products to help SMB clients drive more revenue and reduce income leakage.

Leverage first-party data to strengthen business relationships and de-risk lending.

Offer a digital receivables solution for small businesses that deposits funds directly into your institution.

Minimize ACH debit origination applications from SMBs – offer digital payment processing through Finli instead.

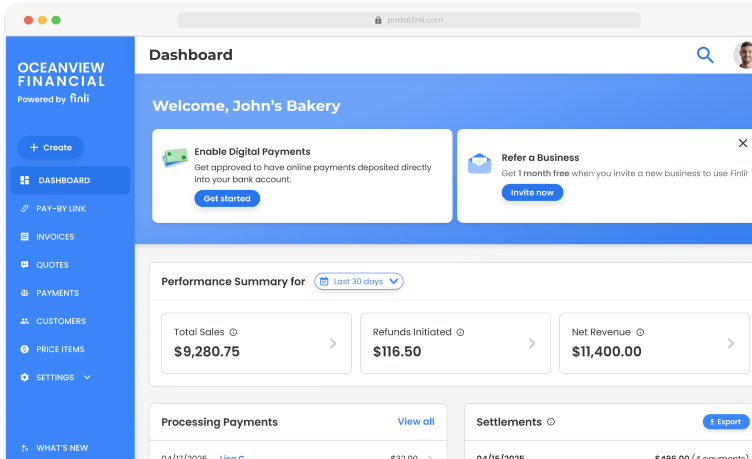

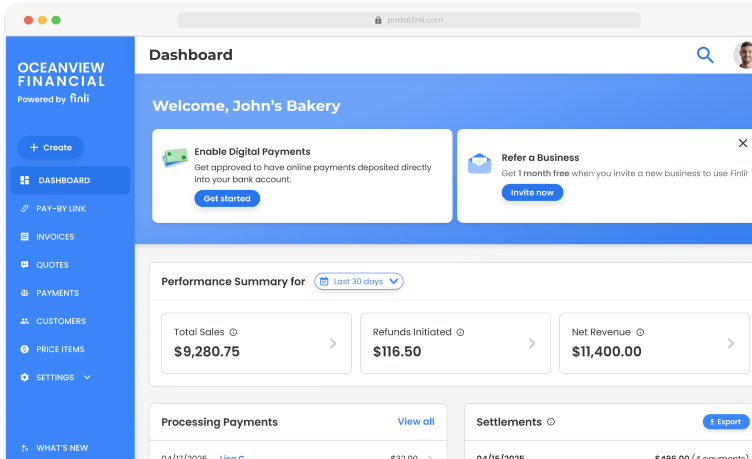

Stand out from competitors with a fully branded, business toolbox that drives real value for small businesses.

Your traditional checking account + ACH products just aren’t moving the needle.

Instantly launch impactful products to help SMB clients drive more revenue and reduce income leakage.

Leverage first-party data to strengthen business relationships and de-risk lending.

Offer a digital receivables solution for small businesses that deposits funds directly into your institution.

Minimize ACH debit origination applications from SMBs – offer digital payment processing through Finli instead.

Stand out from competitors with a fully branded, business toolbox that drives real value for small businesses.

Finli helps you deliver the tools SMBs need to thrive, while leaving room for you to shine.

Support your merchant services and card strategies.

Rely on direct data from your customers to lend smarter.

Attract small businesses and deepen banking relationships.

Finli helps you deliver the tools SMBs need to thrive, while leaving room for you to shine.

Support your merchant services and card strategies.

Rely on direct data from your customers to lend smarter.

Attract small businesses and deepen banking relationships.

Single Sign-On (SSO)

Custom Integration

Single Sign-On (SSO)

Custom Integration

Finli meets rigorous standards for data security, availability, and confidentiality.

All payment transactions and customer data stay protected.

Payments and customer info stay safe with 256-bit SSL data encryption.

Finli conducts verification on all new businesses using our platform.

Always active transaction monitoring ensures businesses can receive payments without fear of fraud.

Finli meets rigorous standards for data security, availability, and confidentiality.

All payment transactions and customer data stay protected.

Payments and customer info stay safe with 256-bit SSL data encryption.

Finli conducts verification on all new businesses using our platform.

Always active transaction monitoring ensures businesses can receive payments without fear of fraud.

As a Public Benefit Corporation, we help FIs meet CRA requirements and support underrepresented businesses.

As a Public Benefit Corporation, we help FIs meet CRA requirements and support underrepresented businesses.

Finli is built for banks and credit unions that believe in relationship banking. Let’s bring real value to your small business clients – and real growth to your institution.

Finli is built for banks and credit unions that believe in relationship banking. Let’s bring real value to your small business clients – and real growth to your institution.