The CPI inflation calculator uses the Consumer Price Index for All Urban Consumers (CPI-U) to calculate changes in the prices of all goods and services purchased for consumption by urban households.

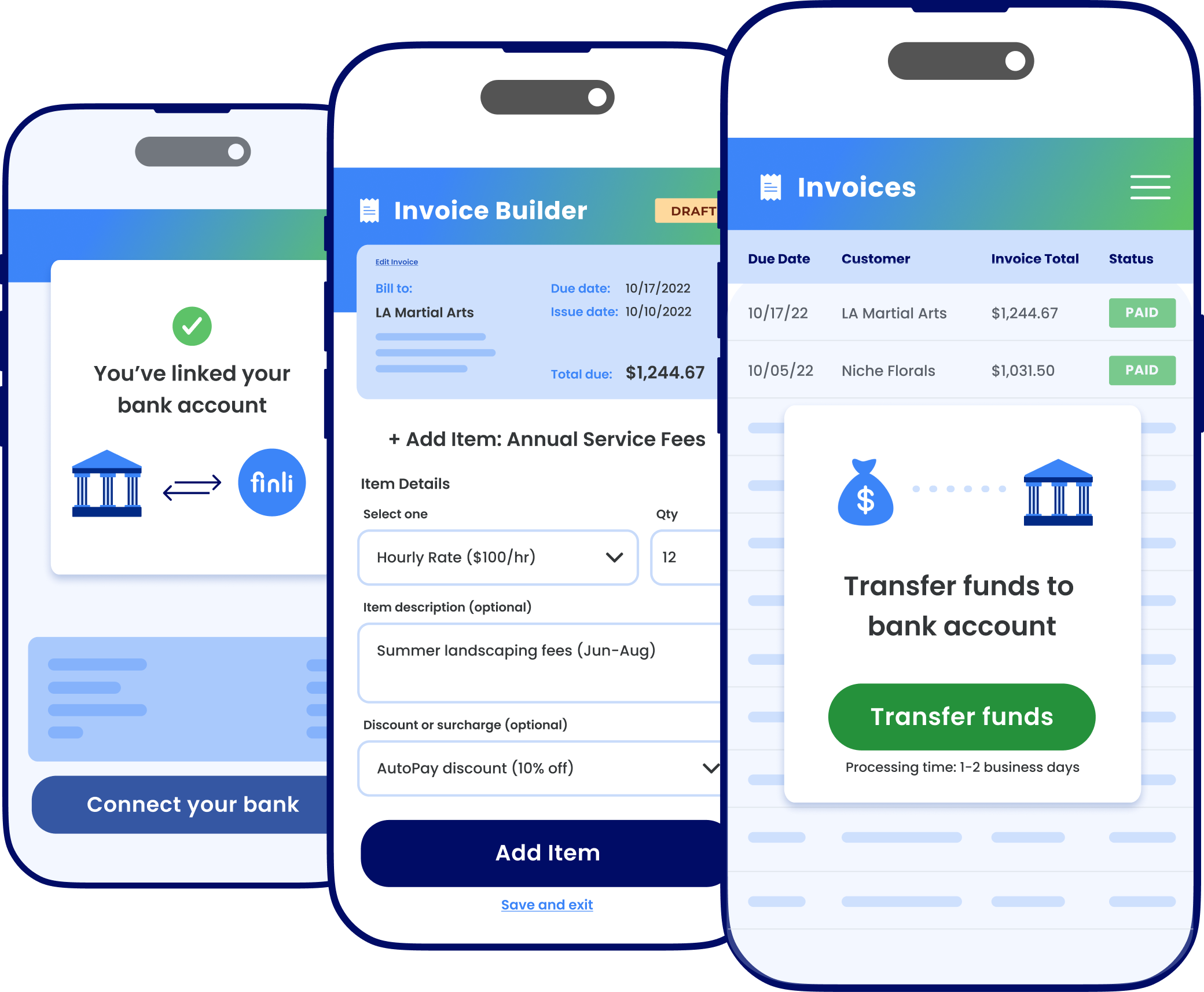

Want to do even more with invoicing?

Yes. Businesses, small or big, have been negatively affected by inflation. With almost all prices increasing (products and services), your pricing model should change as well. If you want to know exactly how much inflation is causing you to lose money, use our inflation calculator above.

Do you need an easy-to-use payment management system? Sign up for Finli (no credit card required)

In order to deal with inflation, small businesses are increasing their own prices, improve productivity, cutting down costs and streamlining client payments. If you need a great tool for easy invoicing, recurring payments and effective client payment management, try Finli.

Have you ever wondered if you’re charging enough? When was the last time you increased your prices? Should you charge more for your services to keep up with inflation? You’re not alone.

85% of small businesses are concerned about the impact of inflation on their businesses.

Finli loves small businesses, so we’ve built a simple test to help you understand where your prices would be if you raised them at the same rate of consumer price increases.

The Consumer Price Index (CPI) is a measure of the average change over time in prices paid by urban consumers for a market basket of consumer goods and services. The inflation rate is calculated as the percentage change in the CPI from one period to another.

The inflation rate is calculated by dividing the change in the CPI by the CPI in the previous period and multiplying by 100. For example, if the CPI in January is 100 and the CPI in February is 105, then the inflation rate for February is 5%.

Inflation is a general increase in prices and fall in the purchasing value of money. It is measured as the percentage change in the Consumer Price Index (CPI) from one period to another.

The CPI is a measure of the average change over time in prices paid by urban consumers for a market basket of consumer goods and services.

The main difference between inflation and CPI is that inflation is a general increase in prices, while the CPI is a measure of the change in prices for a specific basket of goods and services.

For example, if the inflation rate is 2%, it means that prices in general have increased by 2%. However, the CPI may show that prices for some goods and services have increased by more than 2%, while prices for other goods and services have increased by less than 2%.

Real customer success stories, expert business advice, and more.

The Consumer Price Index (CPI) is a measure of the average change over time in prices paid by urban consumers for a market basket of consumer goods and services. The inflation rate is calculated as the percentage change in the CPI from one period to another.

The inflation rate is calculated by dividing the change in the CPI by the CPI in the previous period and multiplying by 100. For example, if the CPI in January is 100 and the CPI in February is 105, then the inflation rate for February is 5%.

Inflation is a general increase in prices and fall in the purchasing value of money. It is measured as the percentage change in the Consumer Price Index (CPI) from one period to another.

The CPI is a measure of the average change over time in prices paid by urban consumers for a market basket of consumer goods and services.

The main difference between inflation and CPI is that inflation is a general increase in prices, while the CPI is a measure of the change in prices for a specific basket of goods and services.

For example, if the inflation rate is 2%, it means that prices in general have increased by 2%. However, the CPI may show that prices for some goods and services have increased by more than 2%, while prices for other goods and services have increased by less than 2%.