Discover why businesses are choosing Finli over QuickBooks for seamless invoicing, effortless payment processing, and unparalleled flexibility in managing clients and payments.

Use our calculator to see how much you can save with Finli compared with QuickBooks.

Save on transaction fees and embrace all the features offered by Finli.

Take your business to new heights with professional invoices and a digital suite of back-office tools.

¹ Option to pay 3% CC processing fees or charge back to customers.

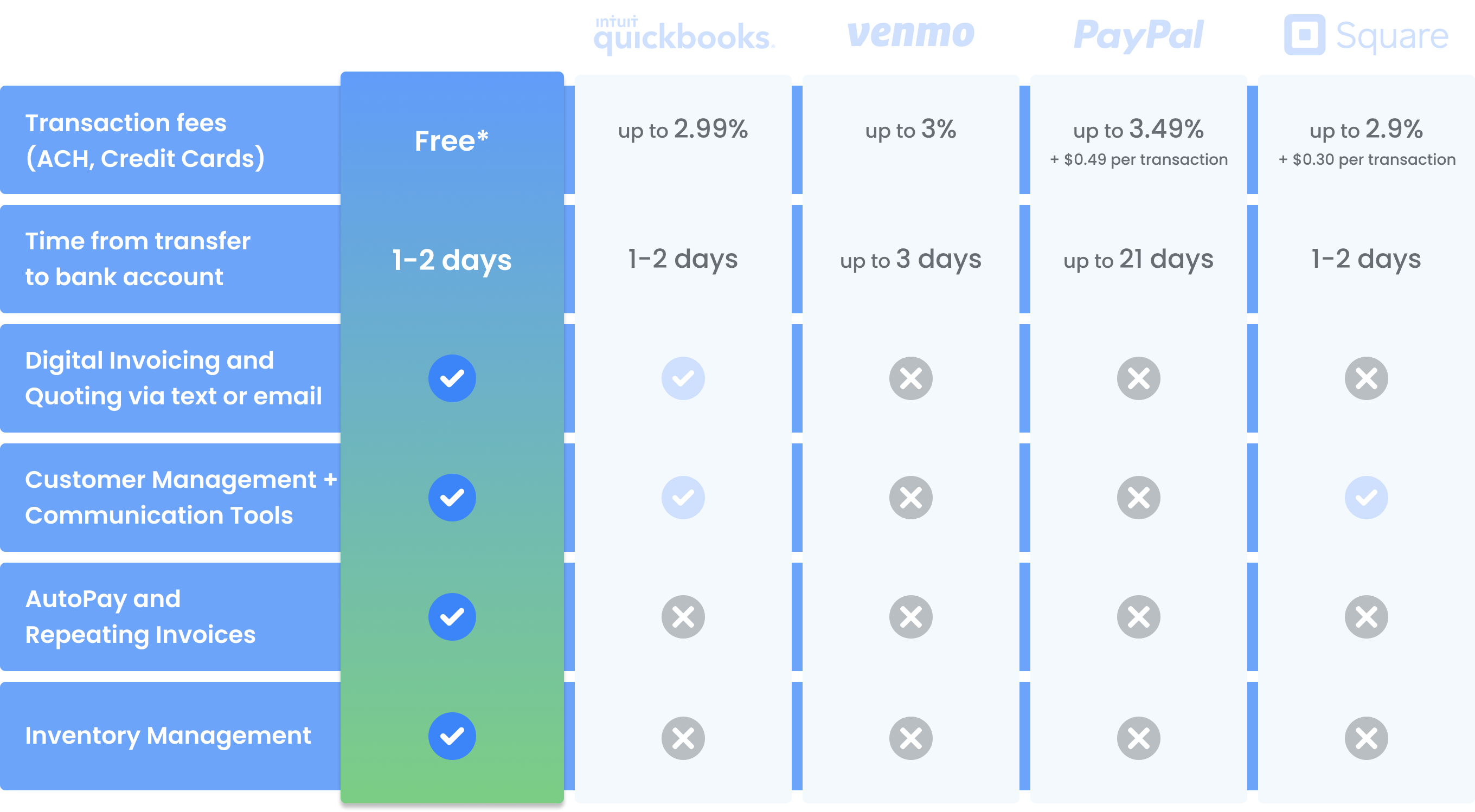

See how Finli stacks up against other platforms.

¹ No ACH fees. Opt to pay credit card processing fees or charge back to customers.

¹ Option to pay 3% CC processing fees or charge back to customers.

Real customer success stories, expert business advice, and more.