Introduction

Melody and Dave need a new payments app. They run a small professional coaching business. Initially more of a side-gig, they now have several regular C-suite clients and enough payment streams that they’ve decided to make it a full-time operation. Business is good. But when Melody and Dave go to bill clients, peer-to-peer apps like Venmo or Cash no longer feel quite right. For one, the fees seem out of proportion.

Even more important, though, are privacy and security since Melody and Dave work with some high-profile executives. They’ve heard of peer-to-peer payments being accidentally shared or sent to the wrong person. Needless to say, such a mistake could be catastrophic at their stage. Melody and Dave would also like an app for billing that supports recurring payments. Altogether, they need a payments platform that’s secure, cost-effective, and flexible. Most of all, they want it to be simple.

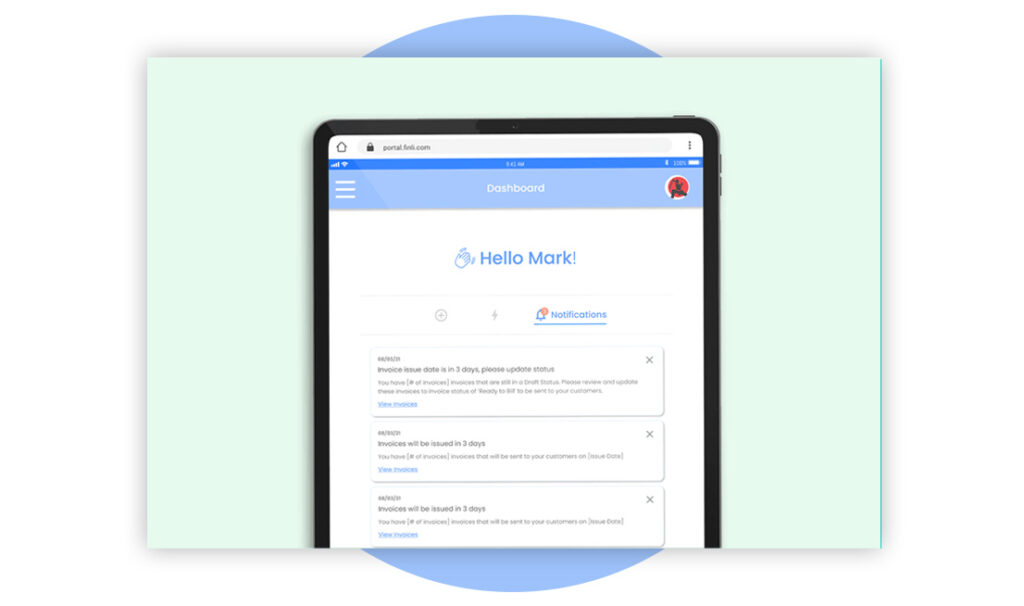

This article discusses how Finli provides a cost-effective payments solution with trusted security and billing features built for small businesses. We’ll look at some of the pitfalls of other payment apps, including security issues and overall cost, and then explore Finli’s recurring billing and flexible payments features. We’ll see how Finli makes managing payments simple so that you can focus on growing your small business.

Uncompromised Security and Privacy

Finli offers uncompromised security and privacy. The Finli app uses the highest encryption protocols available for financial transactions. By leveraging Plaid, Finli combines Advanced Encryption Standard (AES 256), Transport Layer Security (TLS), and multifactor authentication (MFA) to provide complete financial protection. Technical terms aside, Finli never shares your data or transaction history. And Finli prevents misdirected payments through Pay By Link. Just send your client a link, and rest assured, the funds will arrive correctly.

Not all payment apps are this secure or private. Venmo, for instance, has had some issues. Recently, a New Yorker Venmoed $100 to the wrong person. But rather than returning his funds, Venmo froze his account. Aside from the problem of misdirected funds, Venmo lets users broadcast payments. But many have discovered how easy it is to forget to disable this “feature” before paying for something that… let’s just say, you don’t want your entire social network to know about. Such issues have prompted one security expert to hail Venmo as no less than a “privacy disaster.”

Cost-Effective

Many small businesses and freelancers have discovered how peer-to-peer payment fees affect their bottom line. Venmo charges 1.9% + $0.10 for each business payment, while PayPal comes in at 1.5%. What’s more, those apps have pages upon pages of fine print—all outlining ways these companies end up charging you even more for simple payment transfers. At the end of the day, such fees stack up, drain your profit, and cost you growth.

With zero transaction fees, Finli offers a cost-effective payment platform alternative. The Basic or free level includes no transaction fees, unlimited invoices, customer management, and access to all of your customer records and transaction data. Upgrade to a Professional plan to use subscription plans, recurring invoices, and email campaigns. Plans start at $25 per month for 25 customers and $7,500 in transactions. Best of all, Finli’s no-nonsense pricing chart fits on just a single page.

Built for Freelancers and Small Businesses

Finli is built with the needs of small businesses and entrepreneurs in mind. The Finli app offers recurring payments and invoicing. This lets you easily set up memberships, subscriptions, and recurring invoices without the added overhead of extra staff. Such measures can be a huge convenience factor for small business owners like Melody and Dave, saving valuable time and work. Recurring payments can also save you money since one in three of all one-time payments to small businesses is late. Such stalled-out funds create a cash flow problem and prevent you from reinvesting in your business.

Other Finli features include tools for customer relationship management (CRM) and flexible payments. Customers often find it convenient to split payments with a friend, which, like recurring payments, also increases the likelihood of on-time payments. Finli’s CRM tools help you manage customer data and stay in touch with your clients. Use email campaigns to send special promotions to loyal customers, or send a friendly reminder to clients who are past due. Such features make Finli not only cost-effective and secure but also a payment platform leader.

Leading the Next Generation of Payment Platforms

Finli offers freelancers and small businesses a truly next-generation payments solution. With uncompromised security, no-nonsense pricing, and a host of time and money-saving features, Finli is a trusted solution for simplifying payments so that you can get on with your business.

Ready to give Finli a try? Sign up here and start billing clients today.