Managing business finances can be time-consuming and prone to errors, especially for small business owners juggling multiple responsibilities. Accounting integrations, like Finli’s QuickBooks integration helps automate processes, enhance accuracy, and provide real-time financial insights. Keep reading to find out how Finli helps you take control of your finances and streamline your operations.

What does an accounting integration do?

Integrations between your accounting system and other platforms simply connects the software systems to streamline the flow of financial data. By linking tools like payment platforms or CRMs with your accounting software, businesses can automate key processes such as invoicing and expense tracking.

For example, when a customer makes a payment through Finli, the transaction is automatically recorded in QuickBooks. This eliminates the need for manual input, reduces errors, and saves valuable time.

Why Small Businesses Should Link their Financial Tools

Leveraging platforms that easily integrate to your accounting system is essential for small businesses looking to optimize operations. This will help you:

- Generate reports easily to inform smarter business decisions.

- Automate repetitive tasks like billing and tracking payments.

- Minimize errors by syncing data across systems.

- Access real-time updates to monitor cash flow and financial health.

Finli’s QuickBooks Integration: A Solution Built for SMBs

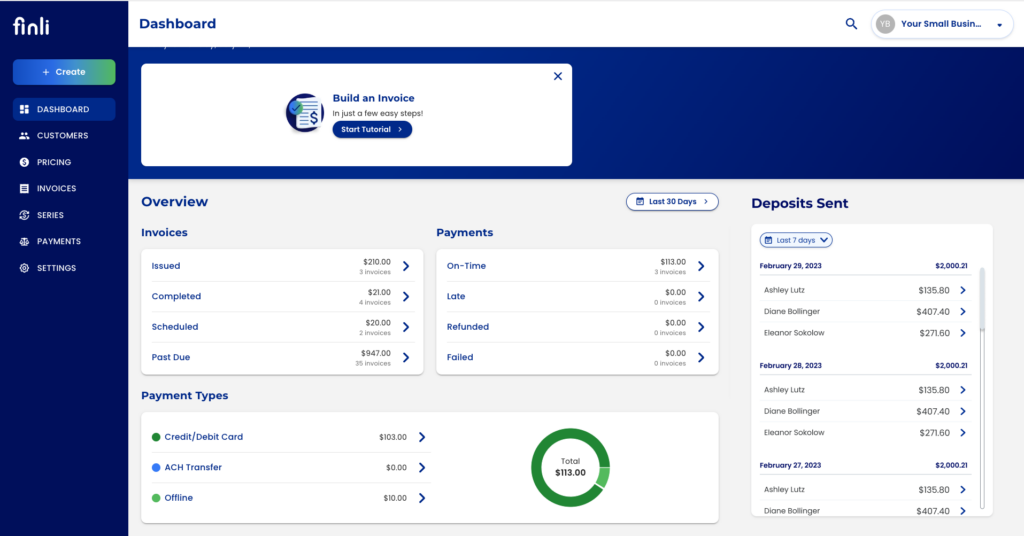

QuickBooks integration on Finli was intended to allow SMBs to get more out of the digital back-office we provide. With a simple one-click connection, all your invoicing and payment data flows in real-time between Finli and QuickBooks!

Here are the main benefits:

- Automated Data Synchronization: Customers, invoices, and payments automatically sync between Finli and QuickBooks, eliminating manual data entry and reducing errors.

- Real-Time Financial Updates: The integration ensures that any new invoices sent or payments collected through Finli are promptly recorded in your QuickBooks dashboard, providing up-to-date financial information.

- Streamlined Invoicing Process: Finli’s integration with QuickBooks allows for automatic numbering of invoices, helping businesses keep track of their billing efficiently.

- Enhanced Customer Management: Upon connecting your QuickBooks account, all existing customers in Finli will be shared to QuickBooks, ensuring consistency across platforms.

- Improved Financial Reporting: With synchronized data, businesses can generate comprehensive financial reports more easily, aiding in better financial planning and analysis.

By leveraging the QuickBooks integration within Finli, businesses can enhance operational efficiency, maintain accurate financial records, and make informed decisions based on real-time data.