Cash flow refers to the movement of money in and out of your business, and controlling it is essential for financial health. In this article, you’ll learn how to manage your cash flow effectively, from tracking expenses to forecasting future cash needs. By understanding and controlling your cash flow, you’ll be better equipped to sustain operations, avoid financial stress, and plan for growth.

What Is Cash Flow?

Cash flow refers to the movement of money in and out of a business or personal account. It tracks how much cash is generated or spent over a specific period. Positive cash flow means more money is coming in than going out, while negative cash flow indicates the opposite.

This measure helps assess financial health, covering expenses, investments, or savings. Businesses monitor it to ensure they have enough liquidity to operate, while individuals use it to manage personal finances effectively.

Why Is Managing Cash Flow So Important for Businesses?

Managing cash flow is critical for businesses to sustain operations and foster growth. It allows a company to pay suppliers, employees, and bills on time, maintaining trust and avoiding late fees. Proper cash flow management helps identify when to invest in new projects, when to cut back, and how to anticipate and manage future expenses effectively.

Without control over cash flow, even profitable businesses can face difficulties staying afloat, as insufficient liquidity may lead to missed opportunities or financial crises.

What Affects Cash Flow

Several factors affect cash flow for a business:

- Sales Volume: Changes in sales directly impact the inflow of cash. A drop in sales can reduce available funds, while increased sales boost cash flow.

- Operating Expenses: Regular expenses such as rent, utilities, and payroll reduce available cash. Managing these efficiently keeps outflows under control.

- Accounts Receivable: Slow customer collections delay cash inflows, hurting liquidity. Shorter payment terms improve cash flow.

- Inventory Management: Holding too much inventory ties up cash. Efficient inventory management ensures cash isn’t locked in unsold goods.

- Debt Payments: Loan repayments and interest drain cash reserves. Poor debt management can lead to liquidity problems.

- Supplier Payment Terms: Favorable terms allow more time to pay suppliers, helping improve short-term cash flow.

- Taxes and Regulations: Tax obligations, changes in tax rates, or regulatory costs can affect the amount of cash available.

- Unexpected Expenses: Unforeseen costs like equipment breakdowns or legal fees can quickly drain cash reserves.

How To Manage Your Business Cash Flow

To manage business cash flow effectively:

- Track Cash Flow Regularly: Use accounting software or a cash flow statement to monitor the money coming in and going out. This helps anticipate shortages or surpluses and plan accordingly.

- Improve Invoicing: Send invoices promptly, offer incentives for early payments, and follow up on late payments to accelerate receivables.

- Control Expenses: Review operating expenses regularly. Cut unnecessary costs and negotiate better terms with suppliers to maintain a healthy balance.

- Maintain Cash Reserves: Keep a cash buffer to handle unexpected expenses or downturns in revenue.

- Negotiate Payment Terms: To keep cash available longer, negotiate longer payment terms with suppliers and shorter payment terms with customers.

- Monitor Inventory Levels: Maintain optimal inventory levels to avoid overstocking. Excess inventory ties up cash that could be used elsewhere.

- Manage Debt Responsibly: Avoid over-leveraging by keeping debt manageable. Pay off high-interest debts first and refinance if necessary.

- Plan for Seasonal Fluctuations: If your business has seasonal highs and lows, prepare by saving cash during peak periods to cover slower times.

- Forecast Future Cash Flow: Project cash flow based on historical data, sales forecasts, and upcoming expenses. This helps anticipate future needs and avoid shortfalls.

How To Measure Cash Flow

To measure cash flow, businesses use several key methods and metrics. Here’s how to do it:

Cash Flow Statement

This financial report tracks cash inflows and outflows over a specific period. It consists of three sections:

- Operating Activities: Cash generated from core business activities like sales, payroll, and operational expenses.

- Investing Activities: Cash spent or gained from investments, such as purchasing equipment or selling assets.

- Financing Activities: Cash movements related to debt, equity, or dividends.

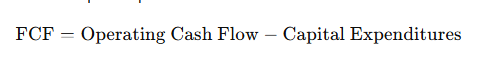

Free Cash Flow (FCF)

This metric shows how much cash is available after accounting for operating expenses and capital expenditures. It’s calculated as:

A positive FCF indicates the business has excess cash for growth, debt reduction, or shareholder dividends.

Net Cash Flow

This is the difference between all cash inflows and outflows in a period. It’s calculated by subtracting total cash outflows from inflows. Positive net cash flow means more cash is coming in than going out, while negative means the opposite.

Operating Cash Flow (OCF)

This measure focuses only on cash generated from regular business operations. It shows how well core activities generate cash. It’s calculated by adjusting net income for non-cash expenses like depreciation and changes in working capital.

Cash Flow Forecasting

Projecting future cash flow based on expected revenues and expenses helps anticipate potential shortfalls or surpluses.

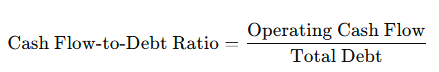

Cash Flow Ratios

Cash Flow-to-Debt Ratio

The business can pay off debt using cash flow. It’s calculated as:

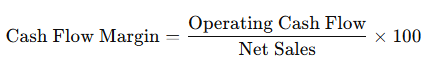

Cash Flow Margin

Indicates the percentage of sales that convert into operating cash flow. It’s calculated as:

Measuring cash flow with these tools provides insights into liquidity, operational efficiency, and financial health.

Positive Cash Flow Vs. Negative Cash Flow

Positive cash flow occurs when a business brings in more money than it spends during a specific period. This surplus allows a company to reinvest, pay off debts, build reserves, or pursue new opportunities. Positive cash flow signals financial health, enabling smooth operations and growth.

Negative cash flow, on the other hand, happens when expenses exceed the inflow of cash. This shortfall can indicate financial stress, often requiring the business to dip into reserves, take on debt, or reduce spending. Persistent negative cash flow can lead to liquidity problems, making it difficult to meet financial obligations or invest in the future.

Types Of Cash Flow

Here’s a breakdown of the different types of cash flow:

1. Operating Cash Flow (OCF)

- Definition: Operating cash flow represents the cash generated from a company’s core business activities, such as sales, payments to suppliers, and operating expenses.

- Why It Matters: OCF shows how well a company’s day-to-day operations generate cash, indicating its ability to sustain itself without external funding.

2. Investing Cash Flow

- Definition: This type of cash flow tracks money spent on or received from investments, such as purchasing equipment, property, or selling long-term assets.

- Why It Matters: Investing cash flow reflects a business’s investment in its future. Positive investing cash flow often results from selling assets, while negative may indicate reinvestment in the company.

- Examples: Purchasing new machinery, acquiring a competitor, or selling off company property.

3. Financing Cash Flow

- Definition: Financing cash flow includes cash received from or paid to external financing sources, such as loans, equity financing, or dividend payments.

- Why It Matters: This section shows how a business funds its operations or growth through borrowing or equity, as well as how it repays debt and distributes earnings.

- Examples: Issuing new shares, paying off loans, or distributing dividends to shareholders.

4. Free Cash Flow (FCF)

- Definition: Free cash flow is the cash available after accounting for operating expenses and capital expenditures (investments in the business).

- Why It Matters: FCF represents the cash a company can use to expand, pay off debt, or return to shareholders after covering operating and capital costs.

5. Discounted Cash Flow (DCF)

- Definition: Discounted cash flow is a valuation method used to estimate the value of an investment based on its expected future cash flows, adjusted to their present value.

- Why It Matters: DCF helps in determining whether an investment is worthwhile by estimating the potential return compared to its current cost.

Cash Flow Forecasts Or Projections

Cash flow forecasts or projections estimate future cash inflows and outflows over a specified period. These projections help businesses predict their financial position, plan for upcoming expenses, and identify potential cash shortages or surpluses. Effective forecasting enables better decision-making regarding operations, investments, and financing needs.

Key Steps to Creating a Cash Flow Forecast:

- Estimate Cash Inflows:

- Forecast expected revenue from sales, services, or other income sources. Include timing and amounts for payments expected from customers.

- Estimate Cash Outflows:

- List all projected expenses, including fixed costs like rent and variable costs like utilities, wages, and inventory purchases. Also, include debt payments, taxes, and capital expenditures.

- Account for Timing Differences:

- Recognize that cash doesn’t always come in immediately after a sale. Consider customer payment terms and seasonal fluctuations that affect the timing of receipts and payments.

- Adjust for Seasonal or Cyclical Trends:

- Factor in periods of high or low activity, such as seasonal sales spikes or slowdowns, which impact both inflows and outflows.

- Incorporate Contingency Plans:

- Include a buffer for unexpected expenses or economic changes to avoid shortfalls.

- Review and Update Regularly:

- Revisit the cash flow projection regularly to adjust for actual results versus the forecasted figures. Update based on new information, such as market trends or operational changes.

Benefits of Cash Flow Forecasts:

- Better Financial Planning: Anticipates cash needs for expenses and investments, helping avoid liquidity issues.

- Identify Cash Shortages: Helps recognize potential cash flow gaps early, allowing time to address them by adjusting operations or securing funding.

- Plan for Growth: Predicts when there will be enough excess cash to fund expansion or new projects.

- Informed Decision-Making: Provides insight into whether the business can take on new expenses, repay loans, or distribute dividends.

What Is A Cash Flow Statement?

A cash flow statement is a financial report that tracks the movement of cash into and out of a business over a specific period. It provides insight into how a company generates and spends its cash, highlighting operating, investing, and financing activities. Unlike other financial statements, such as the income statement or balance sheet, the cash flow statement focuses solely on cash transactions, offering a clear view of liquidity and cash management.

Components of a Cash Flow Statement:

- Operating Activities:

- This section reflects cash generated from the company’s core business operations. It includes cash received from customers, payments made to suppliers and employees, and adjustments for non-cash items like depreciation.

- Example Transactions: Sales revenue, wages, rent, taxes, and inventory purchases.

- Investing Activities:

- Cash flows related to the acquisition or sale of long-term assets, such as property, equipment, or investments, are shown here. This section indicates how much the company is investing in future growth or divesting from past investments.

- Example Transactions: Buying machinery, selling company property, or purchasing marketable securities.

- Financing Activities:

- This part tracks cash flow associated with external financing. It includes money raised through issuing debt or equity and cash used to repay loans or pay dividends to shareholders.

- Example Transactions: Loan repayments, issuing stock, or paying dividends.

Why a Cash Flow Statement Is Important:

- Liquidity Management: Shows whether the business generates enough cash to meet its obligations, such as paying bills and servicing debt.

- Operational Health: A positive cash flow from operations indicates a company’s core activities are healthy and generating sufficient funds to sustain the business.

- Investment Insight: Displays how much money is being invested back into the company, reflecting growth opportunities or potential cash strains.

- Financing Decisions: Helps assess how much a business relies on external financing and how effectively it manages debt.

What’s The Difference Between Cash Flow And Profit?

Cash flow tracks the actual movement of money in and out of a business, reflecting its liquidity and ability to cover immediate expenses. Profit measures financial gain after subtracting expenses from revenue, indicating overall earnings and profitability.

Cash flow shows when cash is received or spent, while profit follows accrual accounting, recording revenue when earned and expenses when incurred. A business can be profitable yet face cash flow problems or have positive cash flow without being profitable. Both are essential for understanding different aspects of financial health.