Credit unions play a crucial role in supporting small businesses across the US. As member-driven nonprofit organizations, they are specifically focused on providing financial resources to their communities.

Because their profits are distributed back to members, there are a ton of financial rewards to be had:

Financial Solutions

Flexible Lending

Traditional banks often have strict lending requirements and may be hesitant to finance startups or businesses with limited credit history. Credit unions, on the other hand, may take a more flexible approach.

They consider a wider range of factors beyond just credit scores, such as business plans, cash flow projections, and the borrower’s character. This makes it easier for small businesses to secure funding, especially during their early stages.

A credit union might approve a loan to a young entrepreneur with a promising business plan, even if they have limited credit history. Or, they might offer a line of credit to a seasonal business that experiences fluctuations in income.

Competitive Rates

Because credit unions are not-for-profit organizations, they don’t have the same pressure to maximize shareholder profits. This translates into lower interest rates and fees for their members, which can save small businesses a significant amount of money on loans, business accounts, and other financial services.

A small business owner might save thousands of dollars by choosing a credit union loan with a lower interest rate compared to a traditional bank loan. Or, they might earn higher interest rates on their business savings account at a credit union.

Personalized Service

Credit unions prioritize building relationships with their members. This means small businesses receive dedicated attention from financial advisors who understand their specific needs and challenges.

These advisors can provide personalized guidance on everything from choosing the right loan product to managing cash flow and growing the business.

A credit union advisor might help a small business owner develop a financial plan, choose the right insurance coverage, or navigate complex financial regulations.

Community & Economic Development

Community-Centric Approach

Credit unions are deeply invested in the communities they serve. They understand that the success of small businesses is vital to the overall economic well-being of the community. This commitment manifests in various ways, such as:

- Providing loans and grants to small businesses that might not qualify for traditional financing. This could include businesses in underserved communities or those operating in emerging industries.

- Partnering with local organizations to offer business development programs, workshops, and mentorship opportunities.

- Investing in community projects that create jobs and stimulate economic growth.

Support for Entrepreneurs

Credit unions recognize the importance of fostering a culture of entrepreneurship within their communities. They actively encourage and support aspiring entrepreneurs by:

- Offering resources and workshops on topics such as business planning, financial management, and marketing.

- Providing access to mentors and experienced business professionals who can offer guidance and support.

- Hosting business pitch competitions and other events to connect entrepreneurs with potential investors and customers.

Investing in Local Businesses

- Supporting local businesses through loans, grants, and partnerships.

- Investing in community development projects that benefit everyone.

- Creating a stronger, more sustainable local economy where everyone thrives.

Additional Advantages of Using a Credit Union as a Small Business

Technology and Convenience

Many credit unions offer modern online and mobile banking platforms that allow businesses to manage their finances efficiently and conveniently. These platforms typically provide features like:

- Secure access to accounts and transactions.

- Bill pay and online payments.

- Mobile check deposit.

- Financial management tools and reporting.

Member-Owned Structure

Unlike banks owned by shareholders, credit unions are owned by their members. Members have a say in how the credit union is run.

The Benefits of Using Finli with Your Financial Institution

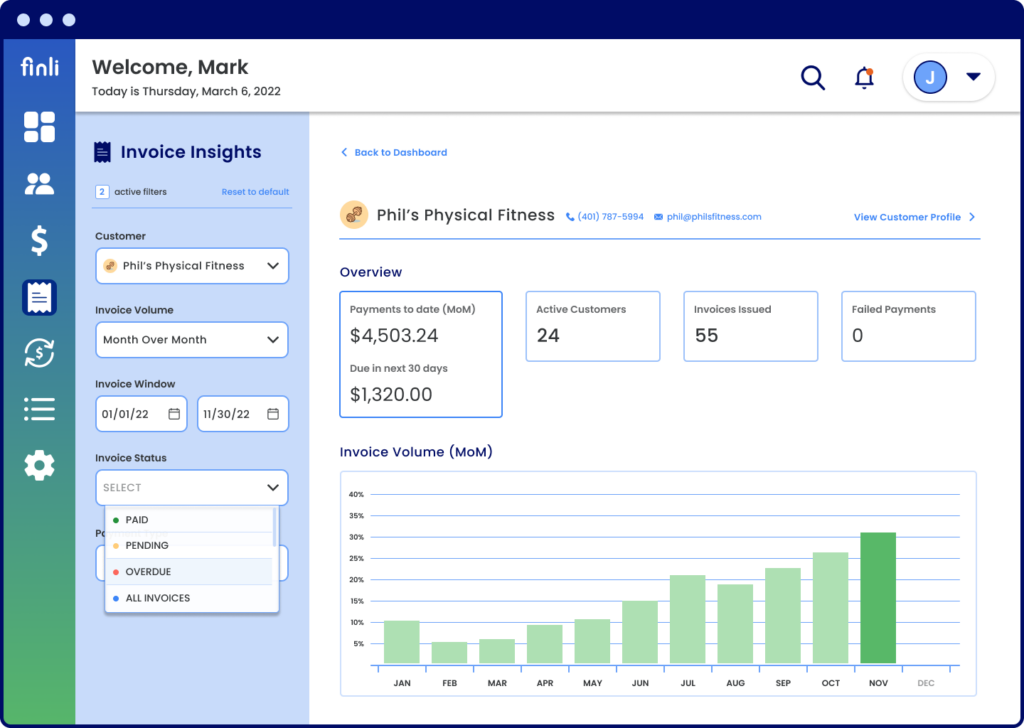

Finli offers several benefits for financial institutions when used in conjunction with their services for small and medium-sized businesses (SMBs):

Increased deposits and non-interest income:

- Reduced deposit leakage: By offering Finli’s integrated digital back-office tools, financial institutions can become a one-stop shop for SMBs, reducing the likelihood of businesses seeking services elsewhere, leading to more secure operating deposits.

- Enhanced non-interest income: Finli charges SMBs subscription fees for its platform, a portion of which can be shared with the financial institution, generating additional revenue streams.

Improved customer satisfaction and retention:

- Empowered SMBs: By providing an all-in-one platform for invoicing, payment collection, inventory management, and customer communication, Finli helps SMBs operate more efficiently and effectively, ultimately boosting their satisfaction and loyalty towards the financial institution.

- Enhanced customer value: Financial institutions can differentiate themselves by offering Finli as a value-added service, exceeding basic banking needs and strengthening customer relationships.

Streamlined operations and reduced costs:

- Reduced operational burden: Finli automates many mundane tasks for SMBs, such as chasing late payments and managing invoices, freeing up financial institution staff to focus on other areas.

- Improved data accuracy and integration: Finli integrates seamlessly with existing financial institution systems, streamlining data sharing and reducing manual work, ultimately lowering operational costs.

Supporting local business communities:

- Championing small businesses: By offering Finli, financial institutions can demonstrate their commitment to supporting local small businesses, fostering positive community relations and brand image.

- Attracting and retaining new customers: Businesses looking for comprehensive financial solutions might be drawn to an institution offering Finli, increasing customer acquisition and retention potential.

By partnering with Finli, these institutions can support their clients by providing access to a robust digital payment system built just for SMBs. Ready to start using Finli for your small business or financial institution? Sign up now.