Today, everything is digital…including payments. Instead of carrying cash and dealing with checks, a lot of small businesses are now using online payment systems to collect money faster and improve the experience for their customers.

Among these, Finli stands out as a compelling alternative, offering robust features and incredibly low fees (just $39/moth).

What Makes Digital Payment Systems Beneficial for Small Business Owners

Digital payment systems facilitate electronic transactions between buyers and sellers. They’ve become increasingly important in modern business due to several factors:

- Convenience: Digital payments offer convenience for both businesses and consumers. They eliminate the need for physical cash or checks, allowing transactions to be completed quickly and securely online or via mobile devices.

- Global reach: Digital payment systems transcend geographical boundaries, enabling businesses to engage in transactions with customers worldwide. This opens up new markets and opportunities for growth.

- Cost-effectiveness: Digital transactions are often cheaper than traditional methods such as wire transfers or processing checks. This can lead to cost savings for businesses, especially those operating on tight budgets.

- Security: Many digital payment systems employ advanced security measures such as encryption and authentication protocols to protect sensitive financial information. This reduces the risk of fraud and unauthorized access.

- Faster transactions: Unlike traditional payment methods that may take days to clear, digital payments can be processed almost instantly. This speed accelerates the flow of funds, improving cash flow for businesses.

- Integration with other systems: Digital payment systems can often be seamlessly integrated with other business systems such as accounting software or inventory management systems, streamlining operations and improving efficiency.

- Customer expectations: With the rise of e-commerce and online shopping, customers increasingly expect businesses to offer digital payment options. Not providing these options can put a business at a competitive disadvantage.

What Makes Finli a Great Option for Payment Management

Finli offers several features that make it a great option for payment management:

- Customizable payment options: Finli allows businesses to create customized payment plans tailored to their specific needs. Whether it’s recurring payments or one-time transactions, businesses can easily set up and manage payment schedules.

- Automated payments: With Finli, businesses can automate payment processing, saving time and reducing administrative overhead. This feature streamlines the payment collection process and ensures timely payments from customers.

- Flexible payments: Finli supports various payment methods, including credit/debit cards, ACH transfers, and Pay-by-Link. This flexibility allows businesses to cater to a diverse customer base and offer convenient payment options.

- Integrated communication: Finli integrates communication tools to facilitate seamless interaction between businesses and customers. This feature enables businesses to send payment reminders, updates, and notifications, improving customer engagement and reducing late payments.

- Robust security: Finli prioritizes security and compliance, implementing industry-standard encryption and security protocols to protect sensitive financial data. Businesses can trust that their payment transactions are secure and compliant with regulatory requirements.

- Insightful analytics: Finli provides businesses with insightful analytics and reporting tools to track payment performance, monitor revenue trends, and identify areas for improvement. This data-driven approach helps businesses make informed decisions and optimize their payment management strategies.

How to Move to Finli from Another Payment Management System

Moving from one payment management system to another, like transitioning to Finli, might seem like a daunting task, but it takes less time and effort than you would expect it to:

Here is how our clients have successfully transitioned to Finli:

Create Your Account

We have made onboarding fast and easy. Click on the SIGN UP button and start your enrollment. You will be guided through our process and get verified fast. At the moment Finli is for US based companies only, so please have this in mind when signing up.

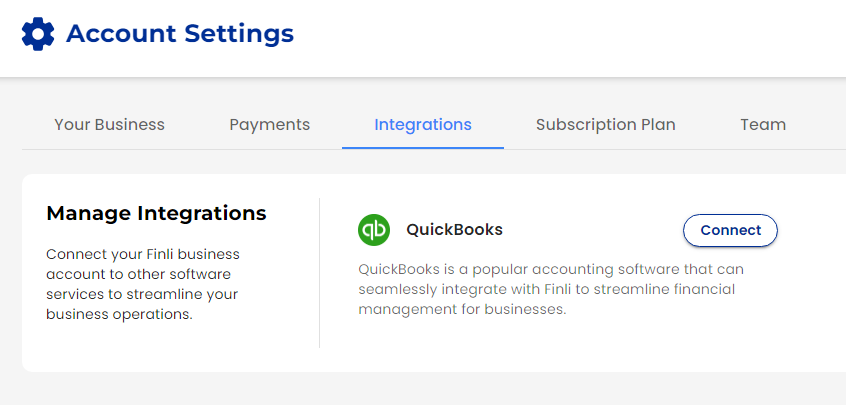

Connect with QuickBooks

If you are already using QuickBooks for your accounting work, Finli integrates fully with it.

Click on SETTINGS and then you can choose INTEGRATIONS from the vertical menu.

Data Migration

Migrating past data to Finli is now easy with bulk export/import features on our Pricing, Customers and Payments tabs. Together with the QuickBooks integration, this would allow you to get set up on our dashboard in ono time.

15 Second Invoicing

Probably the best feature from our clients’ feedback, the invoicing process is fast and easy.

- Create customers – add new clients easily and set up their contact and company information. You do this once, then just add them to each invoice.

- Create products – whatever services or products you provide, there is an option to itemize and set up. With prices, conditions, descriptions.

- Create the invoice or quote – just select the customer, add products from your list and send out the quote or invoice.

Your client will get notified immediately and they can pay. If your invoice is overdue, Finli sends out reminders on your behalf, to make sure you are getting paid.

Ready to move to Finli? Sign up now.