For most small business owners, getting paid has proven difficult time and time again. Predictable and fast payments ensure a consistent cash flow, yet a lot of our customers, who run SMBs, have complained that collecting payments is a constant hassle.

In this guide we delve into various payment methods you can use, from the old-style cash to the latest digital payment systems.

Whether you’re a brick-and-mortar store pondering credit card payments, an e-commerce platform seeking seamless online transactions, or a service provider considering invoicing systems, this article is tailored to demystify the process.

Based on our clients’ feedback, we also present the best strategies to always getting paid on time, how to send invoices and understand transaction fess.

Stay ahead of the curve, understand your options, and cultivate a positive payment experience for both you and your customers.

Which payment option is the best for me?

If you ask us, the quick answer is Finli. With multiple payment options available, no transaction fees and an exceptional experience for you and your customers, we pride ourselves on one of the best digital payment systems available to date.

Since we did set out to prepare an extensive guide, here are the main options used by businesses so far:

- CASH – gone are the days when cash used to be king. Cash transactions are unsafe and impossible to properly track. Imagine being able to know exactly what money you received, come tax season. Finli does that, as you will get extensive payment history data. And, with one of the most secure banking systems in place, your money is always safe.

- CHECKS – used to be the rage years ago, but, just as with cash, more and more companies are leaving this payment option behind. Checks can always bounce and in this case, you will never see your money back.

- CREDIT AND DEBIT CARDS – absolutely essential for all businesses today. Most Americans love to pay with credit cards and Finli makes it possible for your customers to use this payment method. Even more, you have the option to pay 3% CC transaction fees or charge back to customers. Most of our clients have chosen the second option and have saved a fortune in transaction fees.

- ACH – Automated Clearing House, one of the best payment options for your business. If you haven’t heard, Finli has ZERO transaction fees for ACH transactions, which means that you keep 100% of your invoices.

- ONLINE PAYMENTS – up until a few years ago, you’d only have PayPal, Square or Stripe. We have worked tirelessly to create a better option for you: smaller fees, faster payments, CRM, invoice generation, inventory management, recurring invoices, autopay, invoice history and so on.

- MOBILE PAYMENT SYSTEMS – forget about Apple Pay or Google Wallet, Finli offers mobile payments as well.

How to Make Sure You Collect Payments from Your Clients

Late payments are an issue for most companies and, for small businesses, it’s sometimes difficult to make sure they get paid. As many of their clients are people from the community, chasing those slow payers is almost impossible, without ruining lifelong relationships.

Here is how our Finli clients have been able to stay atop of their payment collecting, while still keeping customers happy.

Set Clear Payment Terms

With Finli’s quote management system, you can easily define services and payment terms. Prepare estimates and have your clients approve them before you send the actual invoice. This clears out any potential misunderstandings and helps you get paid.

Provide Easy-to-Understand Invoices

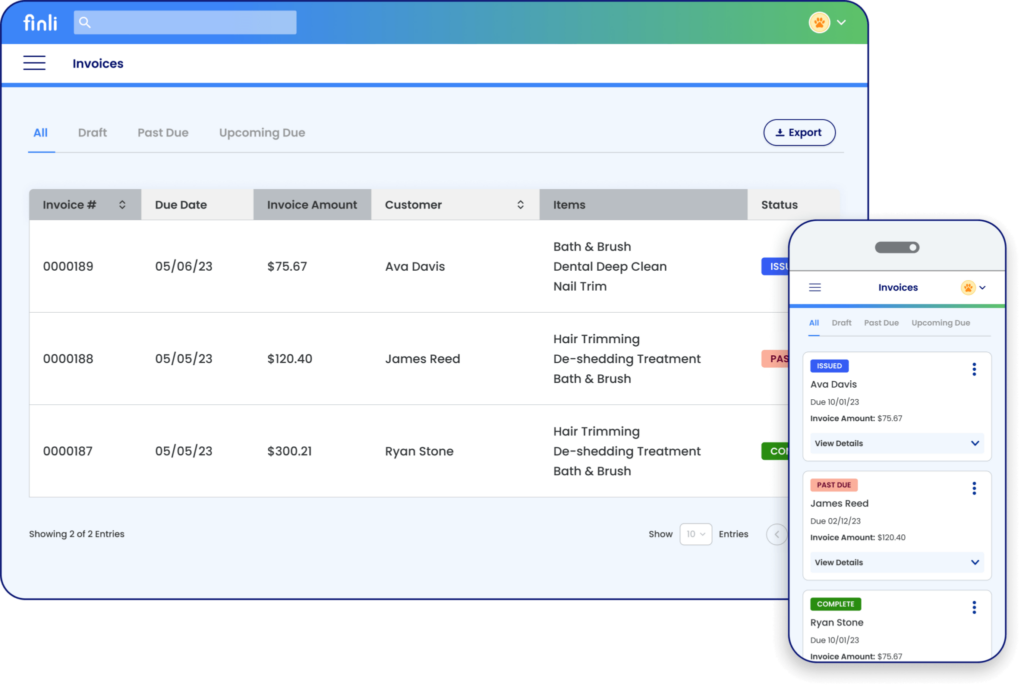

As soon as your clients have approved the conditions, you can create professional invoices from the Finli dashboard. Read more: How to Create an Invoice with Finli

Keep Detailed Records

In most cases you’d wish to have a detailed transaction history for doing taxes, but Finli’s invoice and payment history can do even more. See exactly where your client is in his payment journey, with a detailed invoice history, which will detail the date your invoice was received and when the payment was issued.

Payment history is a great tool to assess client lifetime value and be able to prioritize the clients who yield the most ROI.

Follow Up on Late Payments

A nightmare for most small business owners: chasing clients who “forget” to pay. Finli makes it easier to handle this issue, with invoice reminders you can set up from the dashboard.

Instead of having to send “kind reminder” emails, which we know you don’t want to, let Finli’s payment system handle it all automatically.

Set Up Recurring Invoices and Make Use of Our Autopay Features

Have you ever forgotten to send another monthly invoice for the services you provided? Of course you did, most of our customers have this problem.

With recurring payments, just set up a monthly invoice and then forget about it. When it’s the right time, Finli’s invoice management system will automatically send the bill to your client. Even better, your clients can approve regular payments on a recurring bill.

Master Payment Collecting for Only $39/Month

Use all our features and automate customer payments for a small flat fee of just $39 a month. No additional fees, no surprises. Finli’s payment management system is transparent, easy to use and saves you a lot of money down the road.