Let’s talk about something we’re seeing across the financial industry. Despite providing innovative payment technology to their customers, some banks and credit unions may not have the same tools available for their internal operations. This situation can present challenges for finance and accounting teams responsible for collecting payments from members and clients.

The difference between customer-facing and internal systems can affect efficiency, accuracy, and ultimately, your bottom line. Let’s explore how finance and accounting teams are approaching payment collection and consider approaches that can help save time while improving processes.

The Internal Payment Paradox

Financial institutions generally rely on their core banking platforms for essential operations, though internal payment collection can sometimes present additional challenges. While these systems excel at transaction processing for customer accounts, they may not always include all the specialized workflows that could enhance internal billing operations.

Unless your core provider has specifically developed modules for internal payment workflows and digital payer experience portals, your institution may be managing these processes through manual workarounds or disconnected systems. This creates operational challenges for finance and accounting teams who need the same level of automation and efficiency that exists on the customer-facing side of your business.

What Consumers Expect

Customers experience this with different brands so when they are making payments to your bank they expect the same thing:

- End-to-end branded payment experiences

- Automatic reminders and receipt generation

- Complete refund management capabilities

- Real-time payment processing

These features are expected by consumers and can be difficult for financial institutions to offer internally without intensive custom build-outs. While these capabilities are increasingly common in customer-facing applications, implementing similar solutions for internal operations often requires additional development or manual workarounds.

Scenarios Where This Matters

Let’s look at some common situations where these limitations impact your daily operations:

Fee Collection Challenges When collecting appraisal fees, closing costs, or charges for ancillary services, your team likely juggles multiple systems or manual processes instead of having a streamlined solution.

Loan Repayment Processing The backend of loan management often involves complex payment scenarios that your customer-facing systems handle beautifully—but your internal processes may rely on manual interventions.

Account Funding and Seasoning Opening and maintaining accounts often triggers internal payment needs that lack the automation your customers enjoy for their transactions.

The True Cost of Manual Processes

Many financial institutions rely on highly manual processes to handle these payment types. We’ve seen teams spending hours uploading NACHA files to collect ACH payments—valuable time that could be directed toward more strategic activities.

These manual approaches create several significant problems:

- They consume precious employee time and talent

- They’re naturally prone to human error (we’re all human, after all!)

- They lead to more payment failures due to insufficient funds

- When problems occur, they require even more manual intervention

The most frustrating part? When a payment fails due to insufficient funds in a manual system, your team must handle the exception process by hand instead of benefiting from real-time rejection and automated payment tracking that modern tools provide.

A Better Way Forward

What if your internal billing could be as seamless as the payment experience you offer your customers?

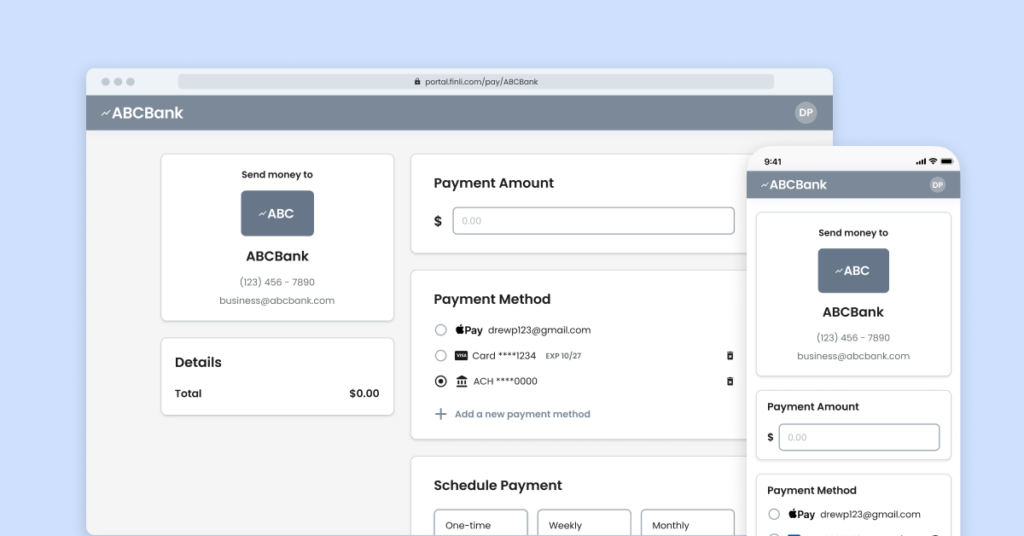

Finli offers exactly that—a solution designed specifically for internal billing teams that provides everything mentioned above. Our platform delivers an end-to-end branded experience with automated reminders, receipt generation, refund management, and real-time processing capabilities.

We’ve designed our solution with financial institutions in mind, understanding the unique challenges your accounting and finance teams face daily. With Finli, you can bring the same level of innovation to your internal operations that your customers already enjoy.

Simple Changes, Significant Results

Financial institutions that have modernized their internal billing processes with solutions like Finli report:

- Dramatic reductions in manual processing time

- Fewer payment errors and exceptions

- Better cash flow management

- Happier employees who can focus on more meaningful work

- Improved member/client experiences as internal efficiencies ripple outward

Ready to Transform Your Internal Billing?

Your financial institution has already proven its commitment to innovation through the services you provide to customers. Now it’s time to bring that same forward-thinking approach to your internal operations.

We’d love to show you how Finli can help your finance and accounting teams collect payments more efficiently, reduce errors, and free up valuable time for more strategic work.

Contact us today to learn how Finli can streamline your internal payment collection process.