Choosing the right digital banking platform is critical for financial institutions to remain competitive in 2025. More than 65% of banks are exploring the potential of next-generation core banking platforms, highlighting the urgency of this decision. Success depends on evaluating scalability, security, API integration capabilities, and extensive digital service integration partners.

The digital banking landscape has transformed dramatically, with financial institutions facing mounting pressure to modernize their technology infrastructure. The global banking API market is expected to reach $43.15 billion by 2026, growing at a CAGR of 19.4% during the forecast period (2021-2026). This growth underscores the critical importance of selecting the right digital banking platform that can support your institution’s long-term strategic goals.

(Source: SDK Finance, Mordor Intelligence)

Understanding Digital Banking Platform Fundamentals

Digital banking platforms have evolved beyond simple online account access. Modern solutions integrate core banking functions, customer relationship management, compliance tools, and third-party services into unified ecosystems. Customization and flexibility remain key criteria. Banking software should still provide a tailored experience and functionality, ensuring that anyone using the software—from the C-suite to everyday users—can access what they need without frustrating roadblocks.

Today’s platforms must handle everything from mobile banking to fraud detection while maintaining regulatory compliance. The complexity of these requirements means that platform selection has become one of the most strategic decisions facing financial institutions.

(Source: Decta)

Core Features Every Platform Must Have

Scalability and Performance Architecture

Your chosen platform must grow with your institution. As institutions grow, any banking software must scale with them, adding users and features without unnecessary hassles or headaches. Look for cloud-native solutions that can handle increased transaction volumes without performance degradation.

Performance metrics to evaluate include:

- Transaction processing speed and throughput capacity

- System uptime guarantees and disaster recovery capabilities

- User capacity limits and expansion flexibility

- Real-time data processing capabilities

Security and Compliance Framework

Security remains the foundation of any banking platform. Financial institutions face heightened cyber threats, with organizations that process cardholder data being 300 times more likely to be targeted by a cyber attack, with the average cost of a breach in that sector topping $5.97 million.

(Source: Arctic Wolf)

Essential security features include:

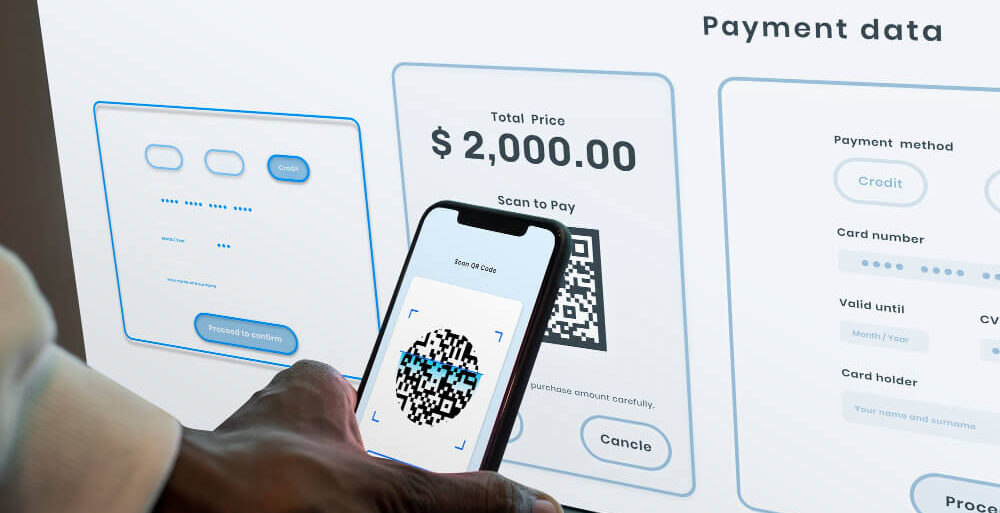

- Multi-factor authentication and biometric verification

- End-to-end encryption for all data transmissions

- Real-time fraud detection and prevention systems

- Automated compliance reporting for regulatory requirements

Mobile-First User Experience

Mobile banking adoption continues accelerating. 74% of people between the ages of 15 and 24 used mobile banking apps in 2021. So, your platform must deliver seamless mobile experiences that match or exceed customer expectations set by leading consumer apps.

(Source:Creatio)

Extensive Digital Service Integration Partners: A Critical Success Factor

One of the most crucial yet often overlooked aspects of platform selection is the ecosystem of integration partners. Modern banking success depends on your ability to quickly deploy new services and adapt to changing customer needs through third-party integrations.

API Ecosystem Depth

Research shows that 75% of the top 100 banks will have made public Application Programming Interfaces available in 2022. Your platform should support comprehensive API management with access to established integration partners for:

- Payment processing and alternative payment methods

- Identity verification and KYC/AML compliance

- Credit scoring and risk assessment tools

- Personal financial management applications

- Lending and loan origination systems

(Source: DashDevs)

Partner Marketplace Access

Leading platforms provide access to curated partner marketplaces where you can rapidly deploy new capabilities. The best banking API providers enable easy integration with industry-leading tools for lending, fraud detection, personal finance, and more, without starting from scratch

(Source: Alkami).

This marketplace approach allows financial institutions to:

- Test new services with minimal development overhead

- Respond quickly to competitive pressures

- Access specialized fintech innovations

- Reduce time-to-market for new product offerings

For example, partnering with specialized providers like Finli enables financial institutions to launch comprehensive small business digital services in as little as 24 hours. Our solution offers white-labeled implementation options that maintain your institution’s branding while providing businesses with professional invoicing, payment processing, and back-office management tools. This approach allows institutions to meet market demand immediately while avoiding the expensive custom development and typical months-long build cycles associated with in-house solutions.

Integration Support and Documentation

Evaluate the quality of integration support your platform provider offers. A good provider should function as an extension of your team, not just a black box with documentation. Look for providers offering developer-friendly APIs, comprehensive documentation, and dedicated integration support teams.

Advanced Technology Capabilities

Artificial Intelligence and Machine Learning

AI integration has become essential for competitive banking operations. AI usage in banking is projected to increase by 32% annually by 2025, highlighting its growing importance. Your platform should include or easily integrate AI capabilities for:

- Personalized customer experience and product recommendations

- Advanced fraud detection and risk management

- Automated customer service through intelligent chatbots

- Predictive analytics for business intelligence

(Source: Netguru)

Open Banking Readiness

Open banking regulations continue expanding globally. One of the big digital banking trends for 2025 is open banking — a model that lets third-party apps access financial data from banks using APIs. Ensure your platform supports current and emerging open banking standards to maintain regulatory compliance and competitive positioning.

(Source: Innowise)

Vendor Evaluation Framework

Financial Stability and Track Record

Research your potential vendor’s financial health and client retention rates. Examine their client base diversity and success stories from institutions similar to yours in size and complexity.

Support and Training Infrastructure

Evaluate the vendor’s ongoing support capabilities including:

- 24/7 technical support availability

- Training programs for your staff

- Regular platform updates and feature releases

- Change management assistance during implementation

Total Cost of Ownership

Look beyond initial licensing fees to understand the complete financial commitment. Factor in implementation costs, ongoing maintenance, integration expenses, and potential customization requirements.

Making the Final Decision

Start your evaluation process by creating a comprehensive feature matrix that maps your institution’s specific needs against platform capabilities. Prioritize features that directly impact your strategic goals, whether that’s rapid growth, regulatory compliance, or customer experience enhancement.

Consider conducting pilot programs with your top two or three platform choices. This hands-on evaluation approach helps identify potential integration challenges and user experience issues before making a final commitment.

Key Takeaways

Digital banking platform selection represents a strategic inflection point for financial institutions. The right choice provides a foundation for growth, innovation, and competitive advantage. The wrong choice can limit your institution’s ability to adapt and evolve in an increasingly dynamic marketplace.

Focus on platforms that offer robust API ecosystems with extensive digital service integration partners, proven scalability, comprehensive security frameworks, and strong vendor support. Remember that you’re not just buying software—you’re investing in your institution’s digital future and your customers’ banking experience.

The financial institutions that thrive in the coming decade will be those that choose platforms enabling rapid innovation, seamless customer experiences, and efficient operations. Take time to evaluate thoroughly, involve key stakeholders in the decision process, and select a partner committed to your long-term success.