Get paid on time and in full so you can run a thriving service business.

Collecting payment from customers can be one of the most exciting parts of running a business; after all, who doesn’t like getting paid?

On the other hand, payment collection can be frustrating if you don’t have the right systems in place. Business owners, particularly solopreneurs, have enough responsibilities on their plate without having to spend valuable time chasing down payments from clients.

This guide has everything you need to choose the best payment method for your business so you can easily and consistently collect money from customers.

Why you need a payment management system

Cash flow

According to a U.S. Bank study, 82% of businesses that failed cited cash flow problems as a factor in their failure.

Businesses inevitably have expenses to pay: equipment, labor, and rent, to name a few. Cash inflow is what will help you offset your business expenses and move towards profitability.

Having a reliable way to collect payment from customers will set your business on the path toward positive cash flow and growth.

Customer experience

As payment technology has evolved, so have customer expectations. Customers want a payment process that’s convenient, predictable, and streamlined.

A convenient payment collection process will help your customers see you more professionally, and ensure that they’ll keep returning to do business with you.

Time savings

As a small business owner, your time is valuable. Your days may be spent acquiring customers, performing your services, and negotiating deals. The less time you spend chasing down payments from customers, the more time you have to grow your business.

How to collect payment from clients

Collecting payment from customers doesn’t have to be complicated. Setting up an efficient payment collection system now will pay off down the line by making payments easy for both you and your customers.

Get a payment management system

Before digital payment platforms existed, businesses had to send clients a paper invoice, which clients would then review and send payment via cash, check, or bank transfer. With online payment management systems, you can collect payments from customers in just a few simple steps.

Your payment management system should make collecting payments simple for both you and your clients. Here are some things to look for in a payment management system:

- Accept different payment options

Your payment management system should be able to accept the most popular forms of payment. This includes major credit cards such as Visa and American Express, ACH transfers, and payment processors such as Paypal and Stripe. The more payment methods you accept, the easier it will be for customers to pay you.

- Option to set recurring payments

For customers that only use your services once, sending them a one-off invoice is sufficient. But what about clients that signed up for ongoing services? Sending a brand new invoice each time is time-consuming and difficult to track.

Your payment management system should have the option to set up recurring payments with clients. You would simply need to enter your client’s information and set the billing frequency and amount; your payment platform should do the rest.

- Integrate with or include a CRM

A CRM (Client Relationship Management) system manages interactions with your clients and leads.

Having a payment management system that ties with your CRM software can streamline your payment collection processes in a number of ways. For instance, you can include a deposit payment link directly in your proposal, helping you secure payment and close the deal all in one process. You can also set up automated payment reminders through your CRM and get notified of overdue payments.

- Tight security

When you collect sensitive data from your customers, like payment information, you want to make sure it’s kept private. Make sure your payment management system will safeguard sensitive information using premium encryption.

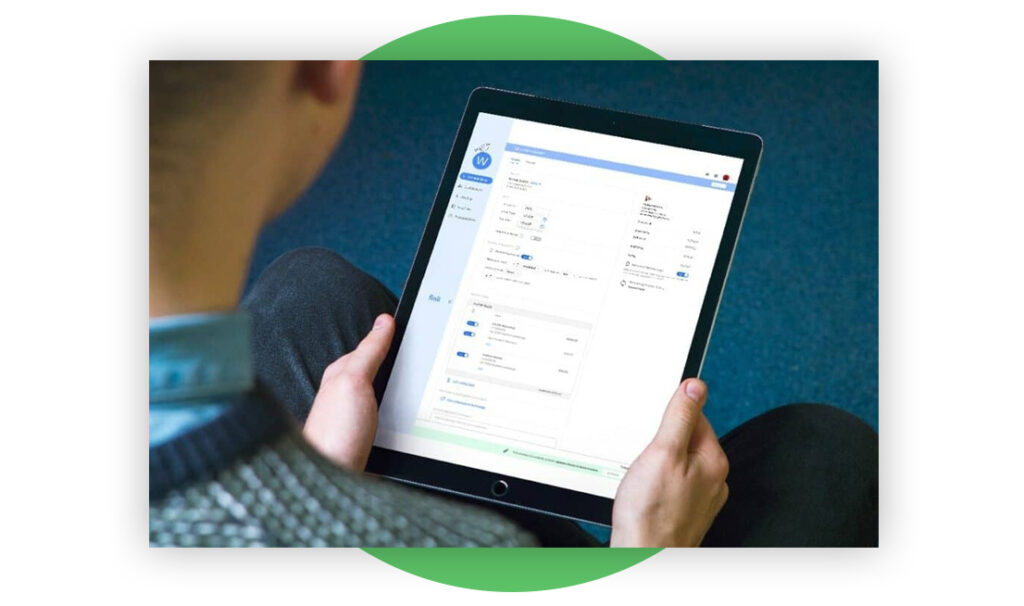

Finli is a popular payment system for service businesses because it has all of these capabilities. Finli is a free payment management system that lets you easily send customized invoices and set recurring payments to multiple parties.

[button link=”https://portal.finli.com/signup” type=”big” newwindow=”yes”] Start using Finli today![/button]

Define your payment terms

Your payment terms tell your customers when and how they are supposed to pay. Make sure to specify:

- When payments are due (one the day the invoice is sent, after 14 days, or at the end of the month)?

- How many payments are accepted (e.g. 25% deposit upfront)

- Which payment methods are accepted (ACH transfer, credit card, etc).

If you haven’t established payment expectations with your clients yet, it’s not too late to start. Ideally, your clients have agreed to the payment terms when they go into business with you and are reminded of each invoice they receive. The clearer your payment terms are, the easier it will be to get paid by your clients.

Collect payment

You can collect payment from clients in one of two ways: via invoice or payment request.

A payment request is normally performed via an online platform such as Venmo or Paypal. Your customer can instantly pay you by either accepting your request or following a payment link.

An invoice, on the other hand, is a document that’s sent to the client that includes the cost of the services rendered by the provider.

For service businesses, invoices are preferred to payment requests for a few reasons. Firstly, invoices can show an itemized list of services, which is helpful for showing customers what services they’re receiving. Secondly, invoices sent through a payment management system can be tracked, which is helpful for accounting and following up. Lastly, invoices are helpful when it comes time to file taxes, holding an organized record of your income.

What if your business requests recurring payments, such as subscriptions, memberships, and packages? In that case, you should look for a payment management system that offers recurring payment options. That way, you can avoid sending a new invoice for repeated services. And with your customer’s authorization, you’ll be able to charge their credit card automatically whenever a payment is due.

Tips for getting paid on time

1. Set payment expectations in the beginning

The best way to prevent late or incomplete payments is to clearly communicate payment terms with clients before rendering services. Some places you should include your payment terms include your proposal, contract, and invoicing.

Ideally, you can have a piece of documentation signed by both you and your clientele. In the worst-case scenario that you would have to send your client to collections, this documentation can help to protect you and ensure you receive payment.

2. Ask for a deposit upfront

Requiring a deposit upfront minimizes your risk of the client ditching the project partway or simply refusing to pay. Deposits can also help to offset your initial costs and improve cash flow.

Deposits typically range between 25%-50% of the entire project cost.

3. Send an invoice immediately

Don’t wait to send your invoices. You should send an invoice shortly after services are performed so that you’re still top of mind with your client and they remember what they’re paying you for.

4. Send polite follow-up emails

Your clients are busy people; if they haven’t paid your invoice yet, it’s possible that the notification got buried in their inbox. If your client is part of a larger organization, it’s also possible that they have a set schedule by which they pay all contractors.

That being said, you want to make sure to follow up on payments so they don’t fall by the wayside.

When following up about payments, be polite but firm. Send a follow-up email one week after payment was due. Remind them of what the payment is for by reattaching the invoice or the payment link.

Get paid on time every time using Finli’s automated payment reminders. Easily customize the email message and reminder schedule to delight your customers and your bank account.

The best way for small businesses to collect payment

You know that getting paid on time is important for your business, but manually keeping track of and following up on payments isn’t the best use of your time. Finli can help you get paid on time and in full through customizable invoices and automated payment reminders. We also make it easy to send set recurring payments and split payments between multiple parties.

Getting set up is easy and free: join the growing number of service businesses streamlining their payment collection today.

Get paid on time, all the time!

[button link=”https://portal.finli.com/signup” type=”big” newwindow=”yes”] Start here! [/button]

Need help getting started? Finli was founded to help small businesses instantly invoice, collect immediate payments, and more seamlessly handle their accounts receivable. Sign up for a free trial here!