How to Set Up Recurring ACH Payments That Actually Get Paid (Without the Headaches)

Your recurring customers should be your most predictable revenue source. Instead, you’re spending hours every month chasing the same clients

Not finding what you’re looking for? Try searching a different term or check out the Learning Center for a library of helpful Finli tips and resources.

Your recurring customers should be your most predictable revenue source. Instead, you’re spending hours every month chasing the same clients

Being treasurer of your sorority or fraternity probably wasn’t what you signed up for when you joined Greek life. Between

When congregation members want to give but can’t because they forgot cash, your church loses more than a single donation—it

Picture this: It’s 6 PM on a Tuesday, and Coach is trying to corral twelve 10-year-olds for soccer practice when

If you’re like most small business owners, you’ve probably been putting off separating your business and personal finances because you

The 2025 tax extension deadline is October 15, 2025. If you already filed for an extension back in April, you

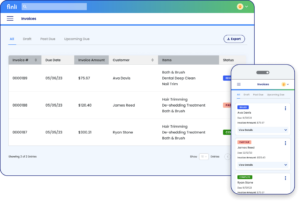

Eliminate the hassle of payment processing. Streamline your business with our easy-to-use payment management system.

FInd out how to get paid as a small business. Using Finli has helped companies streamline online payments and grow

A quote management software streamlines the proposal process, enabling freelancers and small business owners to quickly generate personalized, professional quotes.

As a small business owner, you’ve probably noticed more customers asking about payment plans or walking away from purchases they

Not finding what you’re looking for? Try searching a different term or check out the Learning Center for a library of helpful Finli tips and resources.

Your recurring customers should be your most predictable revenue source. Instead, you’re spending hours every

Being treasurer of your sorority or fraternity probably wasn’t what you signed up for when

When congregation members want to give but can’t because they forgot cash, your church loses

Picture this: It’s 6 PM on a Tuesday, and Coach is trying to corral twelve

If you’re like most small business owners, you’ve probably been putting off separating your business

The 2025 tax extension deadline is October 15, 2025. If you already filed for an

Eliminate the hassle of payment processing. Streamline your business with our easy-to-use payment management system.

FInd out how to get paid as a small business. Using Finli has helped companies streamline online payments and grow more.

A quote management software streamlines the proposal process, enabling freelancers and small business owners to

As a small business owner, you’ve probably noticed more customers asking about payment plans or