How to Choose Fintech Partners Who Innovate Without Creating Chaos

Financial institutions need fintech partners who stay on the cutting edge of technology and continuously roll out valuable new features.

Not finding what you’re looking for? Try searching a different term or check out the Learning Center for a library of helpful Finli tips and resources.

Financial institutions need fintech partners who stay on the cutting edge of technology and continuously roll out valuable new features.

Your community likely includes a diverse mix of businesses—sports clubs, construction companies, professional services firms, property management companies, and service-based

When financial institutions empower small businesses, the economic impact extends far beyond individual transactions to strengthen the very communities they

78% of small business owners report that cash flow management keeps them up at night more than any other financial

Your business banking portfolio likely includes property management companies, construction companies, medical practices, retail stores, professional services firms and more—each

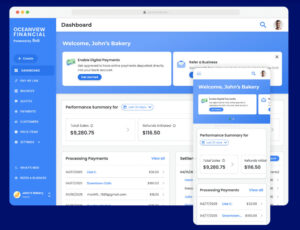

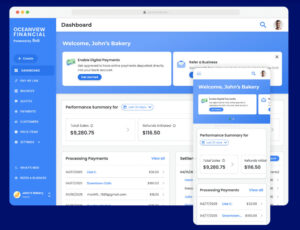

Today’s business clients expect more from their financial institutions than ever before. They’re looking for partners who understand their complete

SMB clients generate $150 billion in annual revenue for the US banking industry. These businesses need digital tools and financial

What Is A CRM Platform? A CRM platform, or Customer Relationship Management platform, is a tool businesses use to manage

Consistent branding has become a key differentiator between thriving institutions and those struggling to maintain customer loyalty. While many financial

Small businesses are the backbone of local economies, yet many financial institutions don’t truly understand what they need. The evidence

Not finding what you’re looking for? Try searching a different term or check out the Learning Center for a library of helpful Finli tips and resources.

Financial institutions need fintech partners who stay on the cutting edge of technology and continuously

Your community likely includes a diverse mix of businesses—sports clubs, construction companies, professional services firms,

When financial institutions empower small businesses, the economic impact extends far beyond individual transactions to

78% of small business owners report that cash flow management keeps them up at night

Your business banking portfolio likely includes property management companies, construction companies, medical practices, retail stores,

Today’s business clients expect more from their financial institutions than ever before. They’re looking for

SMB clients generate $150 billion in annual revenue for the US banking industry. These businesses

What Is A CRM Platform? A CRM platform, or Customer Relationship Management platform, is a

Consistent branding has become a key differentiator between thriving institutions and those struggling to maintain

Small businesses are the backbone of local economies, yet many financial institutions don’t truly understand