When you think of subscription services, you may think of companies like Netflix, Spotify, or Hello Fresh. They’ve cemented their place in our lives by offering services that we can’t live without—and making payment for those services easy and automatic. Small businesses can learn from these payment models and, by extension, what frequent customers want from their providers. And if you offer a service where you could call any of your customers “regulars,” you too could adopt a subscription payment model. Here are some points for you to consider:

1. Subscriptions make it easier for you to retain your current customers.

For most businesses, 80% of their future revenue comes from 20% of their current customers. This is great news because it’s five times more expensive to attract a new customer than to keep an existing one, which means it’s smarter to work to retain current customers than to spend your time and energy into getting onto the radar of new potential customers.

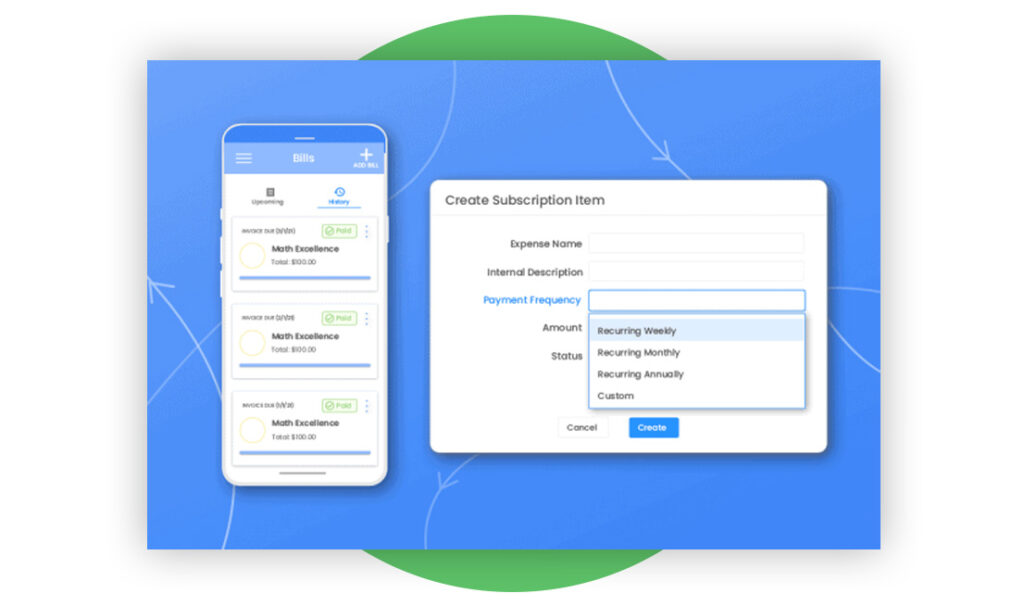

The hardest part is figuring out how to retain your current customers. One way is to make payments easy and convenient for them. By adopting a subscription payment model and setting your customers up for auto-pay, you’re taking all of the friction and frustration out of the payment process. That way, customers know what they’re getting billed for month after month (or week after week, you can customize how often you send out invoices, among other things, on Finli) and you know how much you’re getting paid. Gone are the days of figuring out who paid for what already and what they’re paying for. With Finli’s auto-pay feature, you’ll know exactly. For a more in-depth look at the pros and cons of auto-pay, watch a video here.

2. Subscription payments can alleviate money-related anxiety.

One of the biggest arguments for the subscription model is that it provides reliable, predictable recurring revenue at a set time each month, or at whatever interval you decide to set. This is especially helpful when it comes to planning. With a subscription payment model, you have a chunk of money to take care of necessary expenses (including paying your staff on time!) and to fuel your business growth goals.

In addition, small businesses spend, on average, an hour and a half per day chasing down payments. It’s no fun for you, it’s embarrassing for your customer, and it’s just terrible all around. When you set your customers up on auto-pay, you’d eliminate that predicament completely, leaving you that extra time (and money) to focus on actually growing your business. It’s beneficial to your customers because they no longer have to worry about when their bills are due or when they’re paying. Another thing off both your and their plate. Score!

With Finli, you have the option to offer ACH as an auto-pay option. Finli offers ACH for free, so you can keep every penny that you earn (like you deserve to!).

3. A subscription payment model doesn’t have to disrupt how your business operates.

Worried about how your customers might react if you uproot your current payment system? Don’t be! Consider offering auto-pay as an additional option to what you currently offer. That way, customers who’d like to be set up via auto-pay have that option, and those who don’t can keep doing what they’re already doing. Even having a couple customers on auto-pay can take a lot off your workload, so you can focus on running your small business and not the busywork that comes with it.

Running a small business is already hard enough. Switching to a subscription payment model promises steady and increased income, improved customer relationships, and more mental space so you can continue serving your community by doing what you love most. If this sounds like something you might like, schedule a demo with us here.