Payment processing, invoice + quote generation, and customer + inventory management.

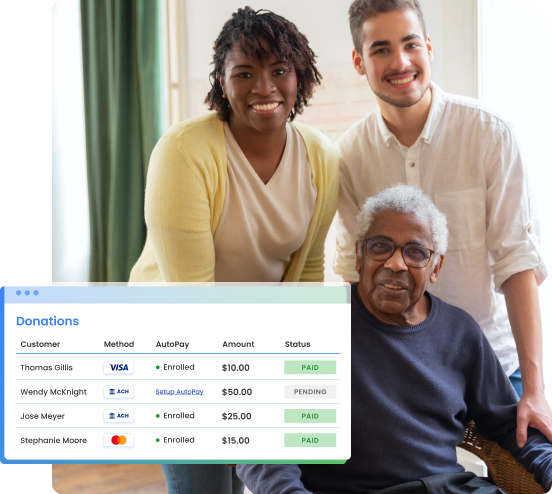

“There are so many benefits of switching to a digital invoicing + payment system.

To have a third party collect payments on your behalf reduces our risks and liability in storing payment information and makes donors much more comfortable.”

A Click Above

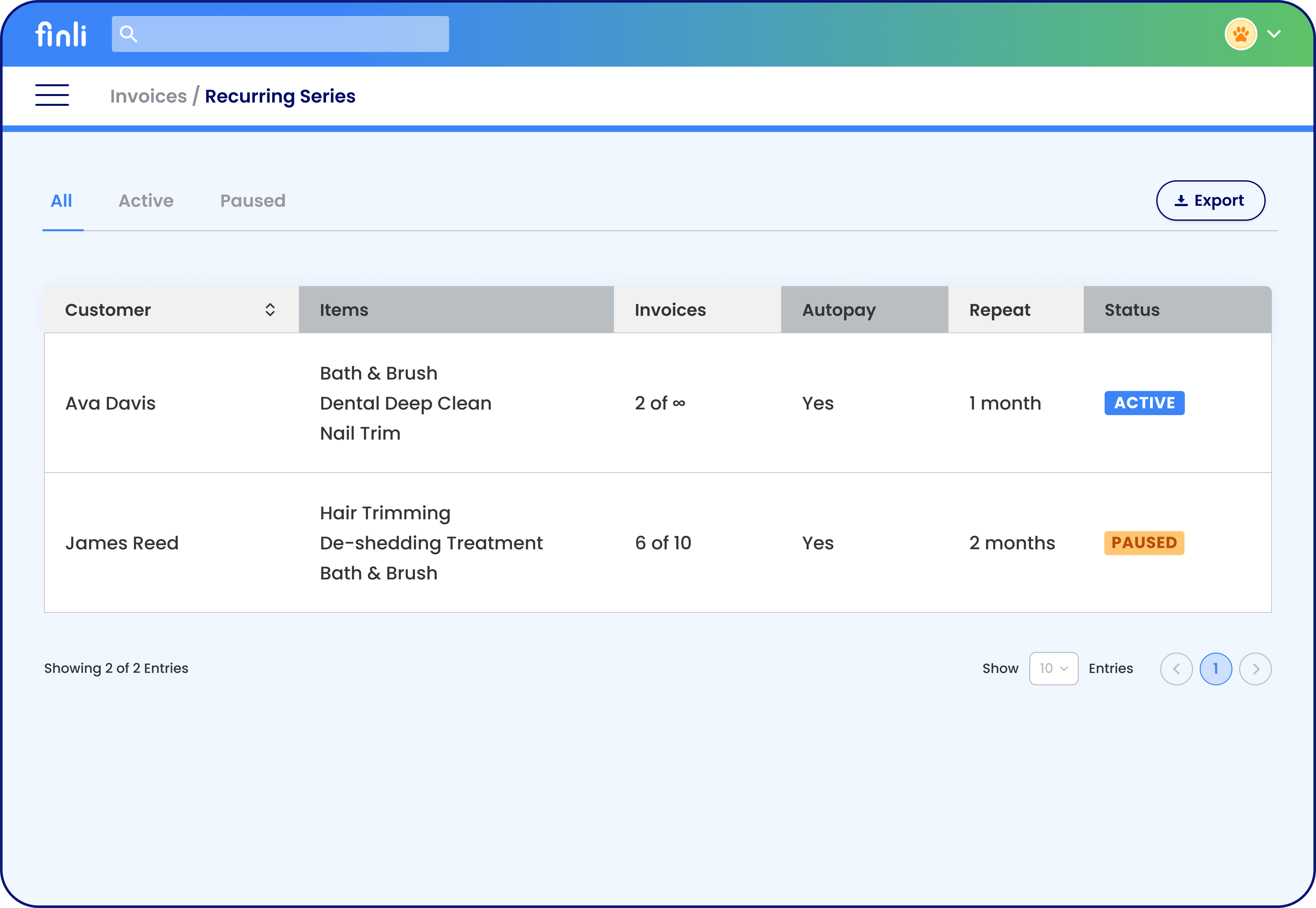

Allow members to set up AutoPay for donations that repeat on a regular basis.

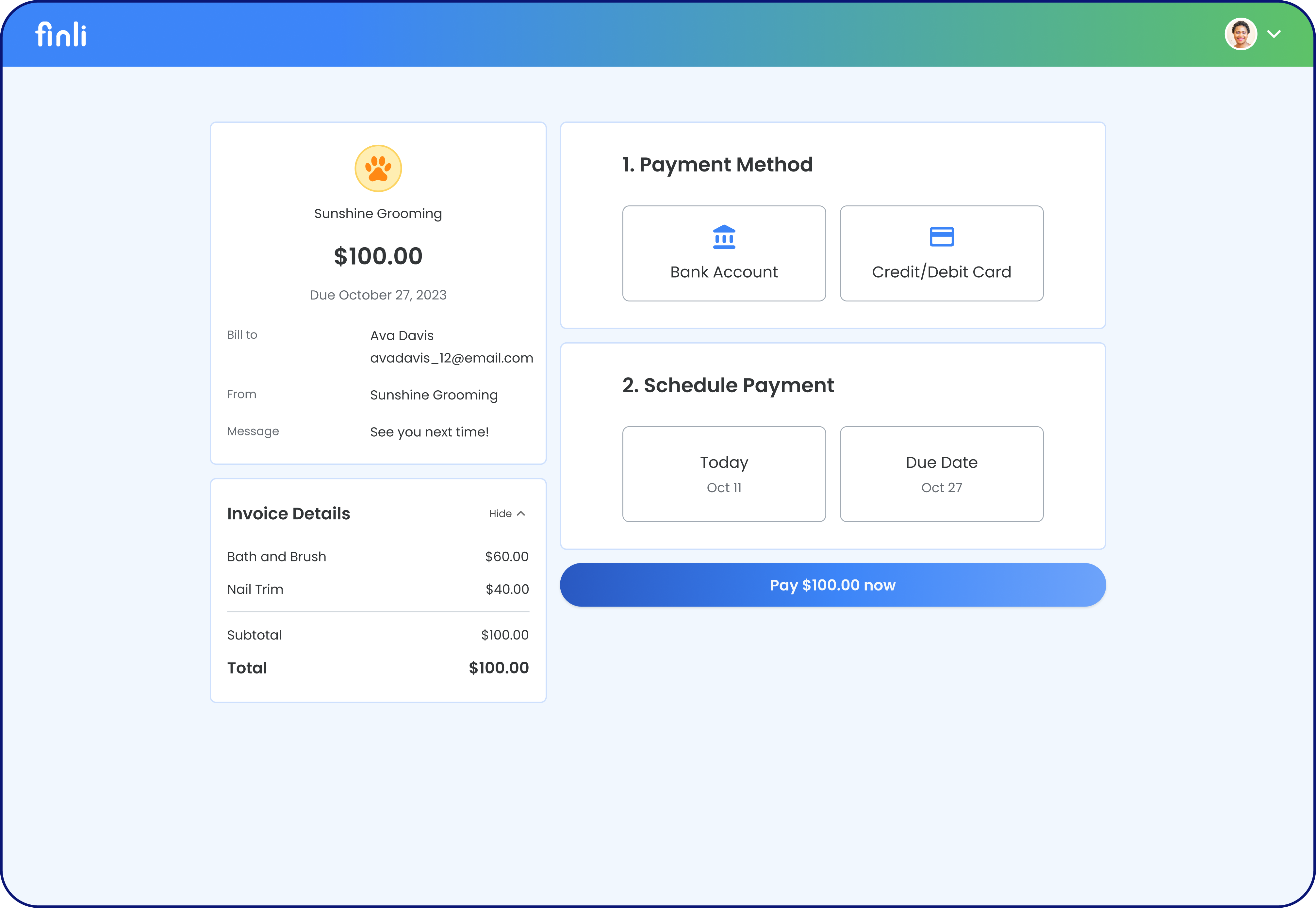

Send professional invoices to customers and collect digital payments right from the bill.

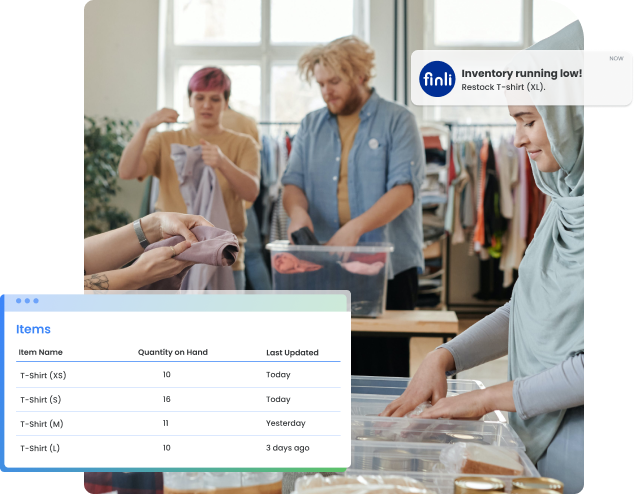

Keep tabs on physical stock quantities and get reminded when it’s time to reorder!

Repeat donors can allow Finli to automatically process payments to your organization on a regular cadence.

Finli’s invoices automatically update your Quantity on Hand and we remind you when it’s time to restock.

Check out the video below for a quick demonstration of our platform.

Learn how Finli helps you manage your business digitally + save time on manual tasks.

Finli does not charge any transaction fees for ACH (bank-to-bank) payments.

If your customers would like to pay via Credit Card, you can elect to pass the 3% processing fee on to them.

Finli initiates an ACH transfer as soon as your customer makes a payment.

The transfer process (from Finli to your bank account) typically takes 24-48 hours to initiate, so you should expect to receive funds 2-4 business days after your customer’s initial payment. The exact timing may vary based on financial institutions and the method by which your customer pays.

No. You can log ‘Offline Payments’ in your Finli dashboard to track payments made via check, cash, or other methods.

Want to do even more with Finli?

Real customer success stories, expert business advice, and more.

Finli does not charge any transaction fees for ACH (bank-to-bank) payments.

If your customers would like to pay via Credit Card, you can elect to pass the 3% processing fee on to them.

Finli initiates an ACH transfer as soon as your customer makes a payment.

The transfer process (from Finli to your bank account) typically takes 24-48 hours to initiate, so you should expect to receive funds 2-4 business days after your customer’s initial payment. The exact timing may vary based on financial institutions and the method by which your customer pays.

No. You can log ‘Offline Payments’ in your Finli dashboard to track payments made via check, cash, or other methods.

Every time you issue an invoice with an inventory item, we will automatically reduce your quantity on hand by the amount included in that invoice. If you cancel an invoice, we will return those items back to your stock.

Want to do even more with Finli?