Consistent branding has become a key differentiator between thriving institutions and those struggling to maintain customer loyalty. While many financial institutions rely on generic solutions that dilute their brand identity, the strategic implementation of white-labeled services offers a pathway to enhanced customer relationships and sustainable growth.

The Critical Importance of Brand Consistency in Financial Services

Financial institutions face an unprecedented challenge today in maintaining customer trust and loyalty. Consistent brand presentation across all platforms can increase revenue by up to 20%, with 33% of businesses reporting that brand consistency helps them boost revenue by 20% or more.

(Source: G2 Branding Statistics)

For community banks and credit unions, this consistency becomes even more crucial. A recent survey revealed that 7 in 10 customers under 55 would switch banks for a better experience, emphasizing the critical role of cohesive branding in customer retention.

(Source: MarcomCentral Financial Branding Research)

The banking industry has historically prioritized product features over brand perception. However, the digital revolution has fundamentally shifted customer expectations, making brand experience as important as the financial products themselves.

Understanding White-Labeled vs. Generic Solutions

White-labeled solutions represent products or services created by one company but rebranded and offered by another organization under their own brand identity. In financial services, white-labeling allows institutions to provide sophisticated digital tools while maintaining complete brand control and customer relationship ownership.

Generic solutions, conversely, offer standardized products with limited customization options. While cost-effective initially, generic solutions often result in fragmented customer experiences that can undermine brand integrity and weaken customer relationships.

Key Differences That Impact Financial Institutions:

Brand Control: White-labeled solutions enable complete customization of user interfaces, messaging, and visual elements to align with institutional branding guidelines. Generic solutions typically offer minimal customization, forcing institutions to compromise their brand identity.

Customer Relationship Ownership: Through partnerships, financial institutions maintain direct customer relationships and data ownership. Generic providers often retain customer data and may even market competing services directly to end users.

Competitive Differentiation: White-labeled solutions allow institutions to offer unique branded experiences that distinguish them from competitors. Generic solutions result in commoditized offerings that are indistinguishable across providers.

The Strategic Benefits of White-Labeled Products

Enhanced Customer Experience

White-labeled solutions create seamless customer journeys that reinforce institutional branding at every touchpoint. When small business clients access digital banking tools, payment processing, or business management features through their trusted financial institution’s platform, the experience feels integrated and trustworthy.

Accelerated Time-to-Market

Developing sophisticated financial technology in-house requires significant investment and expertise. Financial institutions typically need over $20 million and 2-3 years to develop comprehensive digital banking solutions from scratch. Leveraging partnerships allows institutions to launch competitive services within months or days rather than years.

(Source: Satchel Banking Technology Research )

Revenue Growth Opportunities

Partnerships create new revenue streams while strengthening existing customer relationships. Institutions can offer value-added services that generate additional income while increasing customer stickiness and reducing churn.

Operational Efficiency

By leveraging proven platforms, financial institutions can focus resources on core banking competencies while offering expanded service portfolios. This approach eliminates the need for extensive development teams and ongoing technical maintenance.

How Finli Supports Branded Solutions

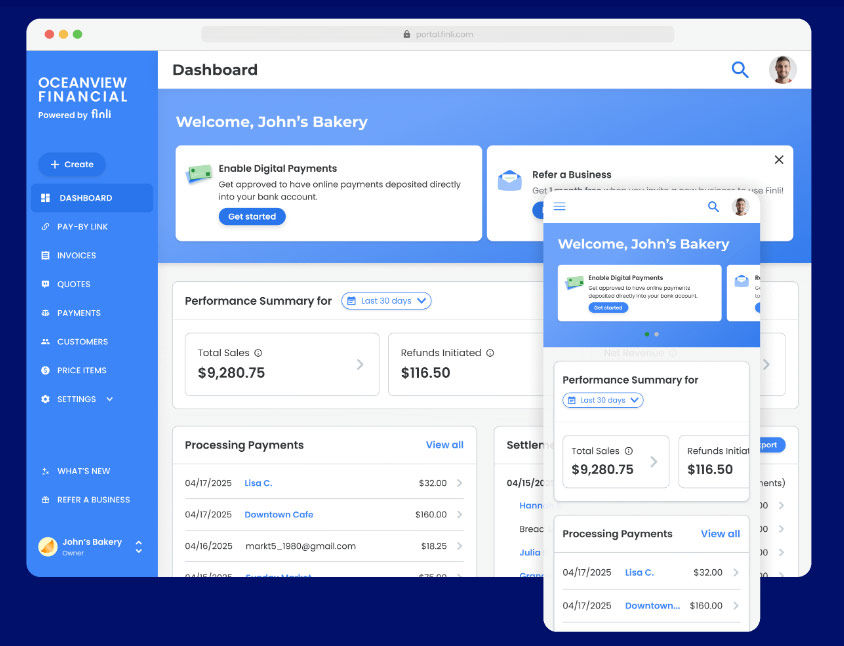

Finli is an excellent partner for financial institutions seeking to maintain complete brand control while offering comprehensive digital services to their SMB clients. The platform enables Financial Institutions to deliver sophisticated business management tools under their own brand identity.

Complete Brand Customization and Control

Finli’s approach ensures financial institutions maintain total brand ownership throughout the customer experience. The platform allows institutions to brand the Finli Dashboard with their own logo and colors, creating a seamless visual experience that reinforces institutional identity at every customer touchpoint. This comprehensive branding extends beyond surface-level customization to create a fully branded business toolbox that enables institutions to stand out from competitors while delivering genuine value to small business clients.

Native Brand Environment Integration

Rather than directing customers to external platforms, Finli enables financial institutions to offer businesses advanced, trusted financial tools in your institution’s brand and native environment. This approach ensures that small business customers remain within the financial institution’s branded ecosystem throughout their entire digital experience, from initial login through payment processing and business management activities.

Turnkey Implementation

Financial institutions can easily launch white-labeled business services with Finli’s turn-key implementation options without requiring internal development resources or compromising brand standards. The platform integrates seamlessly with existing banking systems, including prebuilt integrations with Q2 and Jack Henry, allowing institutions to maintain consistent branding across all digital banking touchpoints.

Flexible Deployment Options

Finli offers multiple deployment strategies to accommodate different institutional branding preferences. Financial institutions can simply create a landing page and offer a white-labeled version of Finli to clients or provide deeper integration by giving clients the ability to log into Finli from within their mobile or online banking experience. This flexibility ensures the solution adapts to existing brand guidelines rather than requiring institutions to modify their established customer experience standards.

Brand Protection and Customer Relationship Ownership

By delivering services through the institution’s brand and native environment, Finli ensures that financial institutions maintain complete ownership of customer relationships and brand equity. Unlike generic solutions that may dilute institutional branding, Finli’s white-label approach strengthens brand recognition and customer loyalty by consistently reinforcing the financial institution’s identity throughout every interaction.

Enhanced Deposit Gathering Through Branded Experience

The platform’s branded approach directly supports business objectives by ensuring SMB deposits consolidate back into your institution while maintaining consistent brand messaging. When small businesses process payments through Finli’s white-labeled platform, the entire experience reinforces their relationship with their financial institution, creating stronger deposit retention and customer loyalty.

Implementing Successful Branding Strategies

Define Clear Brand Guidelines

Successful implementation begins with comprehensive brand guidelines that address visual elements, messaging standards, and customer experience requirements. These guidelines ensure consistency across all touchpoints and partners.

Select Strategic Partners

Choose providers that demonstrate deep understanding of financial services regulations, security requirements, and customer expectations. Partners should offer robust customization capabilities and ongoing support for brand compliance.

Maintain Quality Control

Establish regular monitoring processes to ensure white-label solutions consistently meet brand standards and customer expectations. Regular audits and customer feedback collection help maintain service quality and brand integrity.

Integrate Customer Communications

Develop comprehensive communication strategies that position white-label services as native institutional offerings. Customer education and support materials should reflect institutional branding and values throughout the implementation process.

Measuring Success and ROI

Financial institutions implementing white-label solutions should establish clear metrics for measuring success, including customer adoption rates, deposit growth, revenue generation, and customer satisfaction scores. Regular assessment of these metrics enables continuous optimization and demonstrates the value of white-label investments.

Takeaways

The choice between white-labeled products and generic solutions represents a strategic decision that impacts long-term institutional success. While generic solutions may offer short-term cost savings, white-label partnerships provide the brand control, customer relationship ownership, and competitive differentiation necessary for sustainable growth.

Financial institutions that prioritize consistent branding experiences through strategic partnerships position themselves to thrive in an increasingly competitive marketplace. By offering comprehensive, branded solutions that meet evolving customer needs, these institutions can strengthen relationships, increase deposits, and create new revenue opportunities while maintaining the trust and loyalty that define successful community banking.

The future belongs to financial institutions that can seamlessly blend traditional relationship banking with innovative digital solutions, all delivered through consistent, trustworthy brand experiences that customers value and competitors struggle to replicate.