Small Business clients can often be challenging and costly for community banks to support – making it incredibly difficult to compete with Neobanks and larger financial institutions in the space.

The good news is, it’s not a small space.

SMB clients account for $150 Billion in annual revenue or about 17% of the total U.S. Banking industry. There are 33.2 million SMBs currently in the US and they account for 43.5% of GDP. At the end of 2023, 99.99% of businesses in the US qualify as a small business.

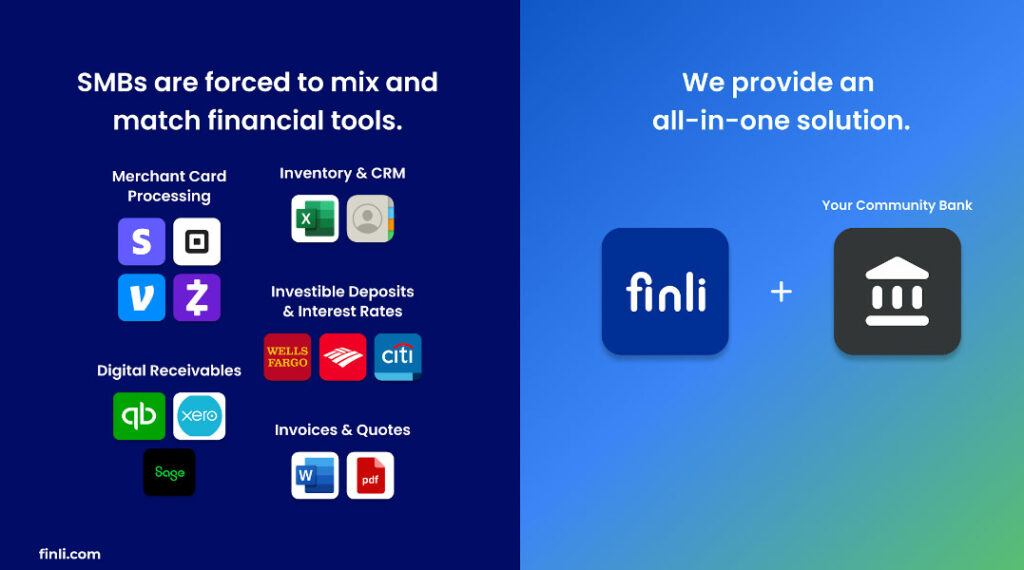

These small businesses often lack financial resources and right-sized digital tools, meaning they end up spending about $340/month on all the different systems they need just to run their business.

When polled, 66% said they would be willing to switch Financial Institutions to receive more digital solutions.

Aite-Novarica Group, Survey of 1,000+ U.S. small business financial decision makers, Q3 2021.

Here are the digital tools Small Businesses currently rely upon to run their business:

- Merchant Card Processing: Stripe, Paypal, Zelle, Venmo.

- Inventory and CRM: Excel, Hubspot.

- Digital Receivables: QuickBooks, Xero, Sage

- Investible Deposits and Interest Rates: Wells Fargo, Bank of America, Citi Bank

- Invoices and Quotes: Microsoft Word, Acrobat

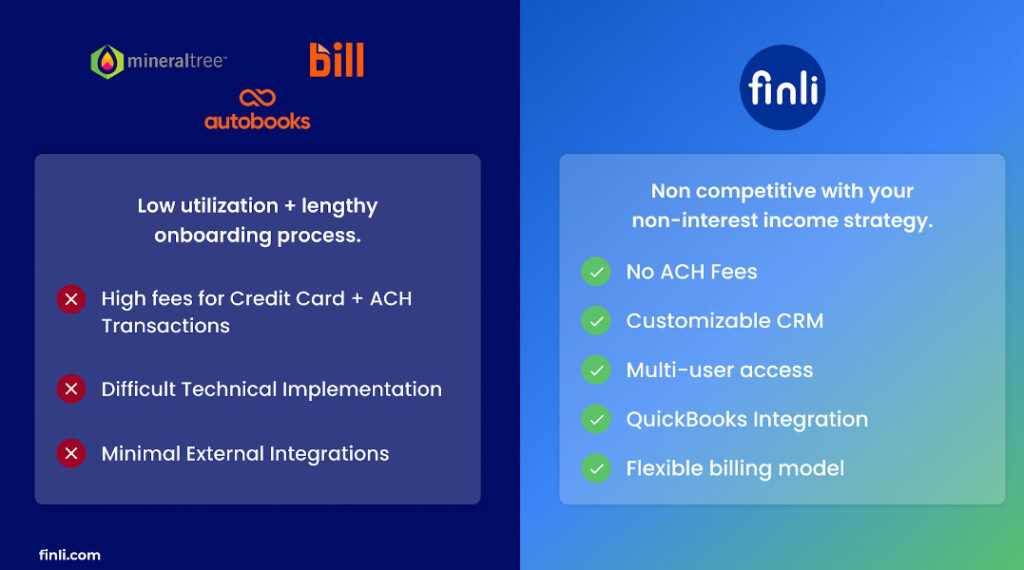

For community banks, competing against Neobanks and Fintechs to provide these additional services can be a very expensive task.

Finli makes it easy to provide an entire suite of digital back office tools to your small business banking clients with no implementation and direct integrations to your core and digital online providers.

With Finli:

- Partners get DIRECT VISIBILITY into small business clients’ receivables;

- Clients get paid and MAKE DEPOSITS FASTER with instant invoicing;

- You can keep data SAFE AND SECURE with bank grade protection;

- Your clients GROW THEIR BUSINESS with easy-to-use customer management tools.

No need to spend money to develop a digital payment system, no need to keep an army of developers and product support teams. Finli does the heavy lifting for you.

How Finli Drives Digital Innovation for Community Banks

Professional and Effortless Invoicing + Payments

Clients can instantly invoice and pay no fees for ACH transactions. They can paid faster and save money with each transactions. For a small business who are forced to use other digital payment solutions, all transaction fees add up and cut into their profit margin. With Finli, they will save hundreds of dollars every month.

Inventory Management

Clients can generate more revenue, when not having to use Excel files and outdated stock tracking systems. Finli’s automated inventory allows your SMBs to maximize their revenue and save a lot of time doing so.

Quotes and Proposals

Instead of using outdated documents or expensive quote management systems, your clients can easily prepare quotes from their bank dashboard, send them to customers, get approved and paid with a click of the mouse. There is also an option to get reminded of outstanding proposals, so they don’t waste time onboarding new clients.

How Community Banks Benefit from Partnering with Finli

We’ve already seen how SMBs have an easier time handling their finances, but community banks see a lot of opportunities for growth working with Finli:

Cash Flow and Credit Insights

Bankers get access to REAL-TIME DATA, which allows them to make better decisions, using customers’ A/R and financial health. Finli helps bridge the gap with vital business insights.

- Leverage receivables data to risk assess your SMB clients’ credit worthiness

- Access MoM growth in invoice volume and dollars processed

- Gain visibility into your SMB customer’s power quality.

Get access to larger clients (up to $2 million), retain smaller clients’ deposits and finally compete with large financial institutions and Neobanks.

If you’re interested in seeing a demo of our digital solutions, get in touch with our partnerships team through our hub for Financial Institutions.

Finli is Present at ICBA Live 2024

Find out more about how Finli can power your community bank. Meet us at the ThinkTech Hub at ICBA Live 2024!