As a financial institution, it can be difficult to identify which digital tools provide the greatest benefits to your clients and your team. Many platforms claim to make manual processes such as invoicing and payment collection easy for small businesses, but which actually live up to their claims and are easy to implement?

When looking for an alternative to AutoBooks, there are several key features and aspects to consider:

Ease of Integration

Seamless implementation is absolutely crucial for financial institutions in rolling out new digital services to clients. Most don’t have expansive technical teams to manage development and quite frankly, don’t have the time to spend months if not years on getting tools up and running.

For this reason, we spent a ton of time ensuring Finli is quick to get going and easily integrated with your existing Digital Online and Core Banking Providers.

Even better, with our white-labeling features, it’s easy to brand the Finli dashboard with your own logo and colors so clients interact with a seamless and cohesive digital experience.

Payment Processing with Direct Settlement

We all know that a small business owner’s number one priority is getting paid quickly and on time. With Finli, give clients the option to collect payment from their customers through either ACH or Card and settle deposits directly into your financial institutions accounts.

No more deposit leakage. No more restricted payment options. Give clients the tools they need to be successful and build deposits within your institution.

User-Friendly Interface

A simple, intuitive user interface is important for both employees and customers. Any digital tools you implement should be easy to navigate and require minimal training for your team and your clients. We strive to make Finli easy to use for everyone.

Comprehensive Features

Ever since our start, we have worked towards offering robust features that can handle invoicing, bill pay, expense tracking, and financial reporting. The more comprehensive the features, the better it can serve the needs of any kind of small business.

You can now find instant invoice + quoting options, inventory management, AutoPay, pay-by-links and customer management systems all within our single easy-to-use platform.

Even further, Finli integrates directly with other accounting systems your clients already love to use (like Quickbooks). While Autobooks require your clients handle accounting through their system, Finli understands that different tools work better for different types of clients. This key distinction significantly increases the likelihood of adoption from within your client base.

Access to Important Data

One of the benefits of offering a tool like Finli to your clients, is the ability for your team to gain a better understanding of your clients business. Deepen customer relationships, make better loan decisions, and identify up-sell and cross-sell opportunities with access to business health insights through our Partner Portal.

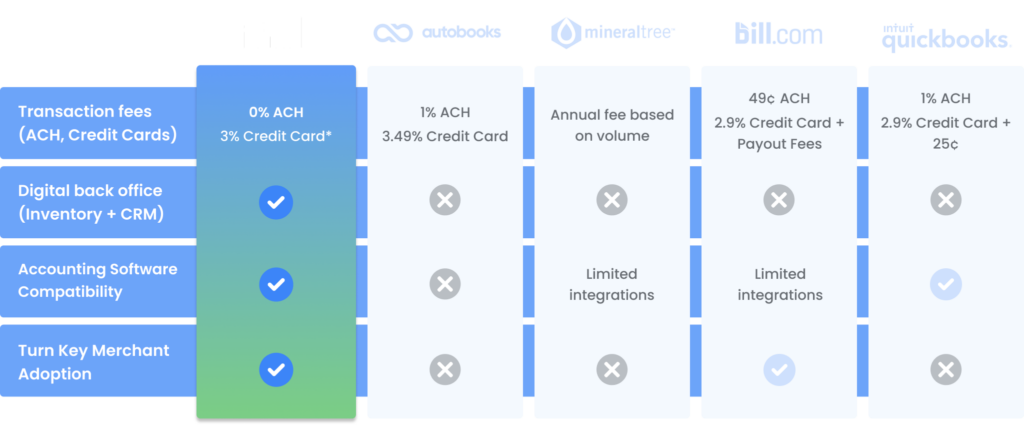

Payment Processing Options

“How would you like to pay today?” Many of your clients customers love ACH transfers (they have a 0% transaction fee when processing with Finli) while others are more inclined to use their credit cards. Some even like to use QR codes and Pay-by-Link options.

Whatever their choice, Finli supports a variety of payment methods and your clients can choose whichever suits them and their customers best. Regardless of the method they choose, deposits are settled directly into your institution.

Security and Compliance

Using Finli ensures your institution adheres to industry-standard security protocols and is compliant with relevant financial regulations. Data encryption, fraud detection, and regular security audits are essential for bank customers and one of our most prized features.

Customer Support and Service

Ensure your clients are treated with the same white-glove service you provide. No matter how easy a payment management system is to use, there is always a need for support. With an extensive knowledge base, the Finli support center and dedicated success team is all you need to provide tailored assistance to your customers.

Cost-Effectiveness

In today’s digital world, customers are sensitive to costs and aware of the various hidden fees that arise. Consider not only the upfront costs but also any transaction fees, monthly charges, and the cost of additional services or features.

We made it easy to budget, with a $39/month ($397/year) service fee. No hidden charges. No surprises. 0% ACH fees, 3% credit card fees (which you can transfer to the clients).

Mobile Accessibility

In today’s mobile-first world, ensure that the platform has a robust mobile app or mobile-friendly interface for on-the-go access. Since we know how much our clients dislike having to install yet another app, we made sure they can use Finli as a web-based platform, easily accessed from their smartphones or computers.

Evaluating these factors will help you consider Finli as a suitable AutoBooks alternative that meets the specific needs of community banks and their small business clients.